Important Keyword: DSC, DSC Registration, DSC Utility, Income Tax Account.

Table of Contents

Register Your DSC On the Income Tax e-Filing Portal

The Digital Signature Certificate (DSC) serves as an electronic signature for taxpayers, verifying and confirming their identity in the digital realm. It encompasses vital details like the user’s name, PIN code, email address, and the certificate’s issuance date.

On the e-Filing platform, registered users can submit their tax returns by affixing their Digital Signature Certificate . To achieve this, users must first enroll their digital signature on the e-Filing portal. This process necessitates the installation of the latest Java software on their systems.

Registered users can execute several actions on the e-Filing platform:

- Register Digital Signature Certificate: Users can initially register their Digital Signature Certificate on the platform.

- Re-Register for Expired Digital Signature Certificate: If a user’s Digital Signature Certificate has expired, they can re-register it on the portal.

- Re-Register for Active Digital Signature Certificate: Even if the Digital Signature Certificate is still valid, users can choose to re-register it.

- Register Digital Signature Certificate of Principal Contact: Additionally, users have the option to register the Digital Signature Certificate of their principal contact.

Prerequisites:

- Registered User of the e-Filing Portal: To begin, ensure you are a registered user of the e-Filing portal with a valid user ID and password.

- Downloaded and Installed em-Signer Utility: Prior to registering your Digital Signature Certificate, download and install the em-Signer utility. Alternatively, you can download and install it during the registration process.

- USB Token from a Certifying Authority Provider: Obtain a USB token from a Certifying Authority Provider and ensure it is plugged into your computer.

- Digital Signature Certificate USB Token Classification: The Digital Signature Certificate USB token you possess should be either a Class 2 or Class 3 Certificate.

- Active Digital Signature Certificate: Verify that the Digital Signature Certificate you intend to register is currently active and has not expired.

- Non-Revoked Digital Signature Certificate: Ensure that the Digital Signature Certificate has not been revoked before proceeding with the registration process.

Steps to Download & Install Embridge

- Visit the income tax portal

- Click on the downloads option from the dashboard

- Click on the DSC Management utility option from the sidebar on the left

- Download Utility (emBridge)

- Extract the files from the zip folder.

- Open the setup application to install the software after accessing the extracted folder

- Select the destination location when prompted and click on next.

- Upon completing the installation process, click on the finish option after reaching the last screen of the setup.

DSC Certificate Installation Procedure

Upon attaching the DSC token to your system, a pop-up will prompt you to initiate the installation process for the DSC Certificate. Follow these steps for the installation procedure, using the ePass token:

- Language Selection Pop-up: Upon the initial prompt, a pop-up window will appear, allowing you to select your preferred language. Choose the language you are comfortable with and proceed by clicking on “Next.”

- Setup Window: After selecting your language, you will be directed to the setup window. Click on the “Next” option to proceed with the installation process.

- Choose the installation location

- Choose the CSP option as Private CSP

- The extraction process begins. Next, you will receive a confirmation window to commence the installation process. Click on yes.

Once the process is complete, click on finish.

Process to Change PIN for DSC Certificate Token Manager

- Launch e-Pass software or the relevant DSC certificate manager

- Click on the change user PIN option from the left sidebar

- Enter the required details in the required fields.

Hence, you will receive a success message on the successful change of the PIN.

Steps to Register DSC on the Income Tax e-Filing portal

- Visit the Income Tax e-Filing portal

Login to the e-Filing portal.

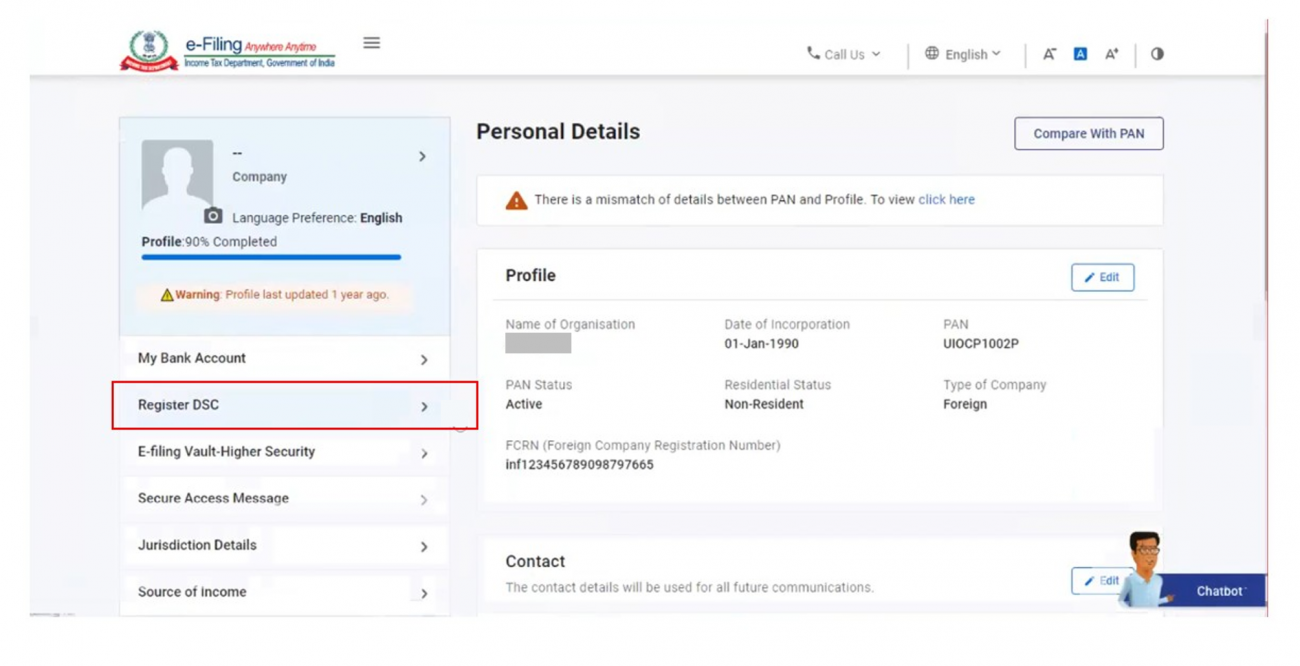

- My Profile

Click on the my profile option from the top right.

- Register DSC

Click on the option to register the DSC from the left side.

- Provider and Certificate

Select the Provider and Certificate. Enter Provider Password. Click Sign.

- Successful Validation

On successful validation, a success message will be displayed with the option to go to the Dashboard.

Read More: How To Pre-validate The Bank Account On The Income Tax e-Filing Portal?

Web Stories: How To Pre-validate The Bank Account On The Income Tax e-Filing Portal?

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments