Important Keyword: Capital Gain Statement, Income from Capital Gains, Income Tax, KARVY.

Table of Contents

Download Consolidated Capital Gains Statement from KARVY

When you sell an investment like stocks, bonds, mutual funds, or real estate, any profit or loss from the sale is considered capital gains. These gains are subject to taxation in the financial year when the transaction occurs. To accurately assess your tax liability and file your returns, it’s crucial to understand your earnings from capital gains during the year.

For investors in mutual funds who hold their investments in a non-demat form, there are various methods to obtain their capital gains data for the financial year. One such method is to obtain a consolidated capital gains report from KARVY, a reputable registrar and transfer agent (RTA) in India.

Investors who use multiple platforms for their investments or invest offline as well can benefit from the consolidated capital gains statement mail-back service offered by RTAs like CAMS and KARVY. This service allows investors to receive a comprehensive report summarizing their capital gains across all their investments, making it easier to manage their tax reporting obligations.

Steps to Download Consolidated Capital Gains Statement from KARVY

KARVY Online

Visit the KARVY investor mail-back service for the capital gains website.

After KARVY Login

After logging in, scroll down and click on the Investor Service tab.

Capital Gains Mail Option

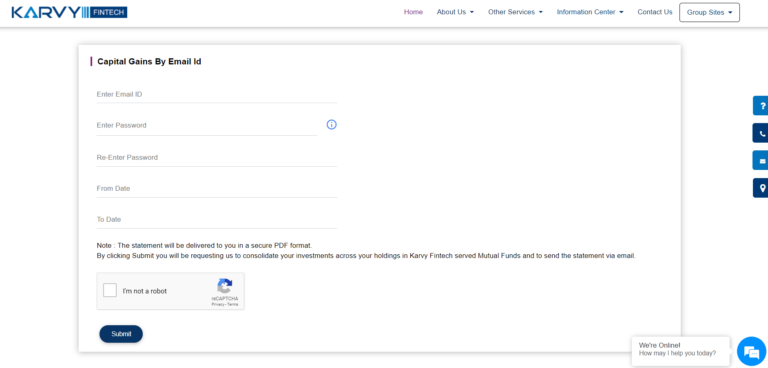

Moreover, click on the capital gain by mail option.

Enter the required details.

To access the KARVY investor mail-back service for the capital gain statement, follow these steps:

- Visit the official KARVY website.

- Navigate to the investor services section.

- Locate the option for the capital gains statement or mail-back service.

- Enter your registered email ID and set a password for opening the attachment.

- Choose “1st April 2021” from the date picker as the start date.

- Choose “31st March 2022” as the end date to get the capital gain statement for the previous financial year.

- Submit the form or request to generate the capital gains statement.

Once you complete these steps, you should receive the capital gain statement via email with the specified date range.

Sample KARVY – Capital Gains Statement

Read More: Section 115QA: Tax on Buyback of Shares

Web Stories: Section 115QA: Tax on Buyback of Shares

Official Income Tax Return filing website: https://incometaxindia.gov.in/