Important Keywords: Form 16A, Form 16.

Words: 973, Read time: 5 Minutes.

Table of Contents

Form 16A is a certificate issued by a deductor (such as an employer, bank, or financial institution) to the deductee (the taxpayer) as proof of tax deducted at source (TDS) on payments made to the taxpayer. It is primarily used for payments other than salaries, such as payments for professional fees, rent, or interest. After filing the TDS return (Form 26Q) for payment other than salary, you need to download Form 16A.

In this guide, we’ll walk you through the step-by-step process to generate Form 16A with ease – helping you stay compliant and on top of your tax responsibilities. Let’s dive in!

Steps to Download Form 16A

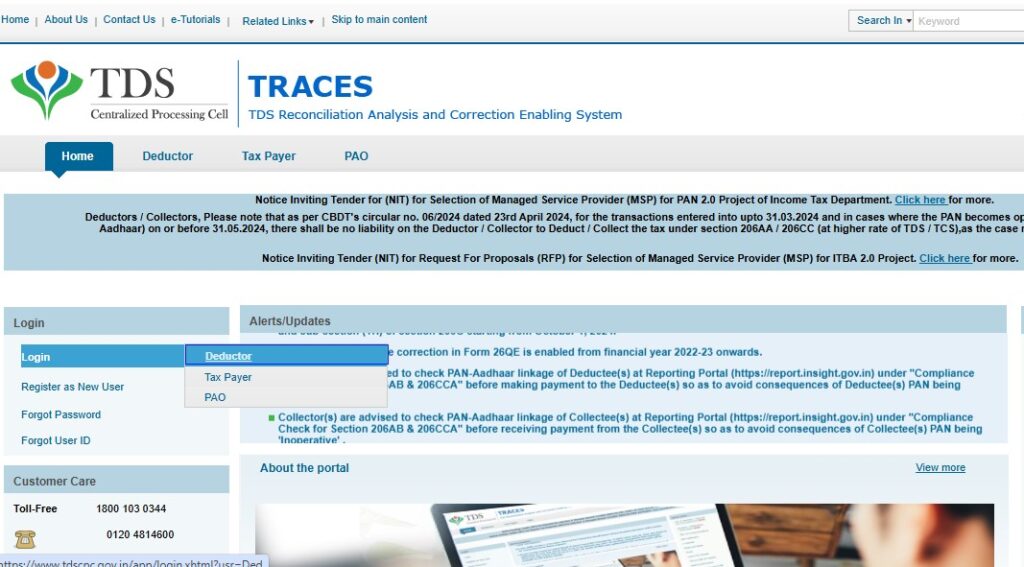

STEP 1: Log in to the TRACES website as a Deductor.

STEP 2: Enter your details such as User ID, Password, TAN and Captcha Code. After entering these details, click on the ‘Login’ button.

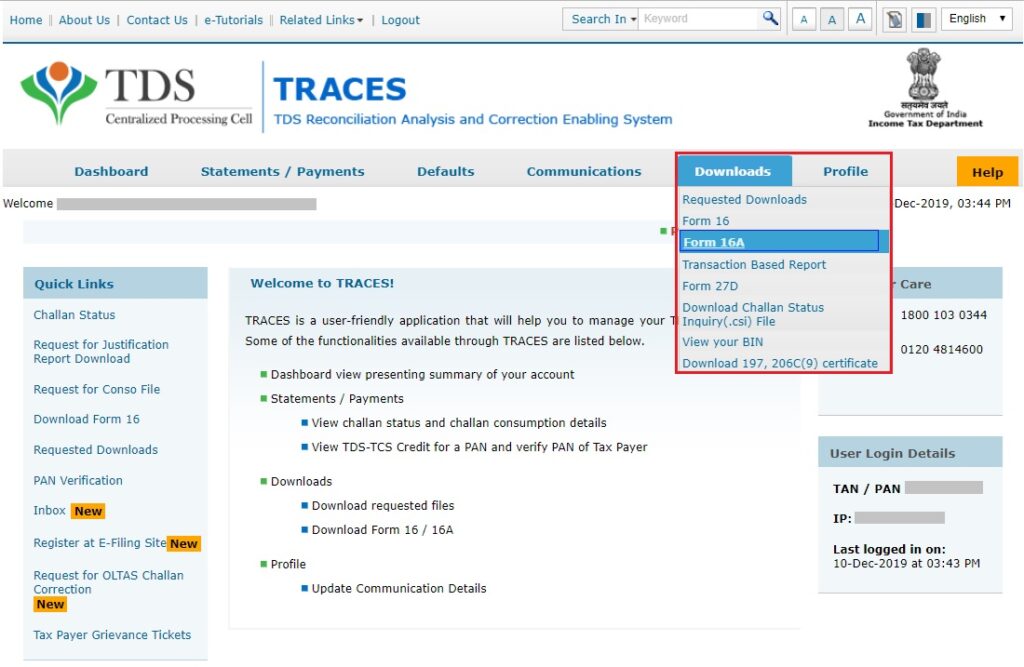

STEP 3: Navigate to the ‘Downloads’ tab, Select ‘Form 16A’ from the dropdown menu.

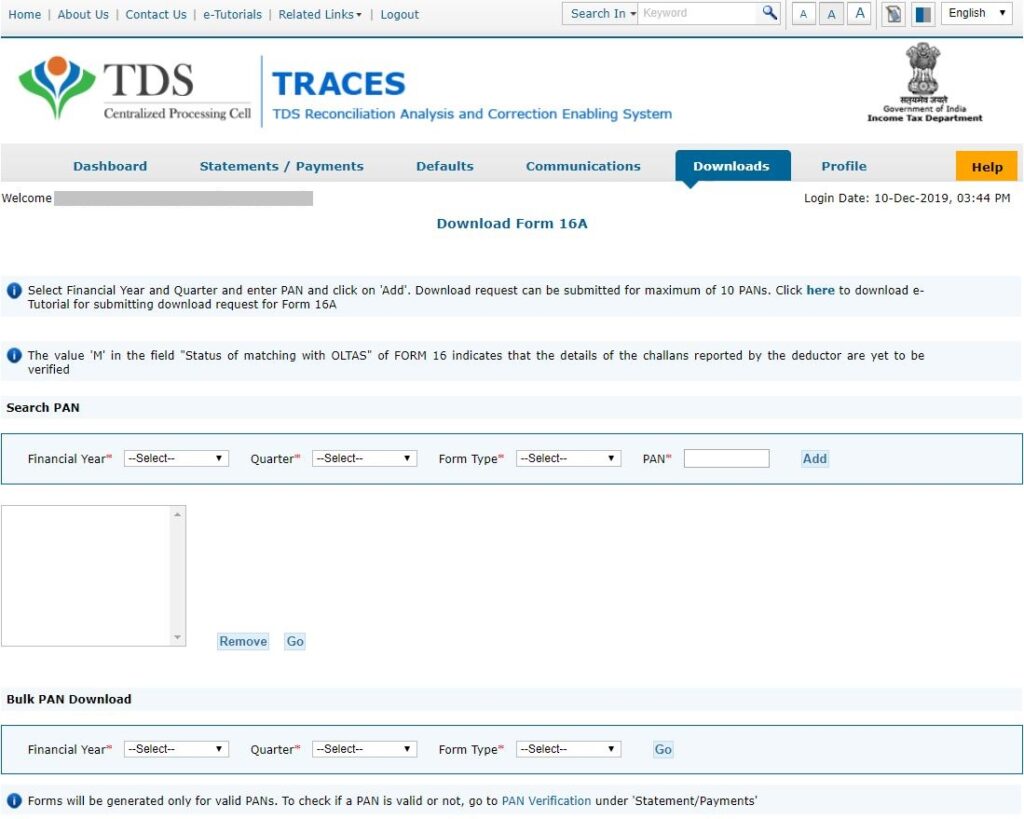

STEP 4: Provide required details – Financial Year, Quarter, Form type and PAN > Click on the GO button.

Deductor can download Form 16A through two download options:

- Search PAN

- Bulk PAN

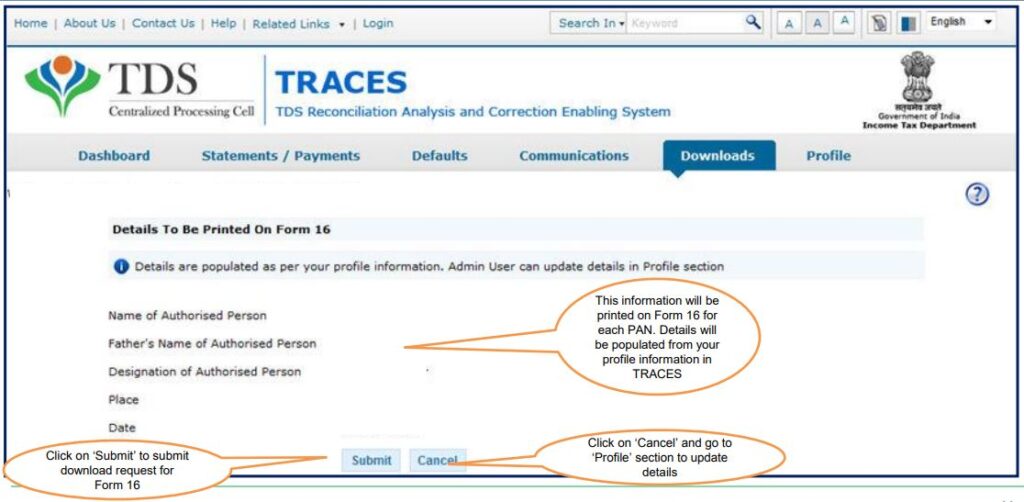

STEP 5: Verify the details of the authorized person.

Details of authorized persons will be auto-populated on the screen which will be displayed on Form 16A. Verify all the details and click on ‘Submit’.

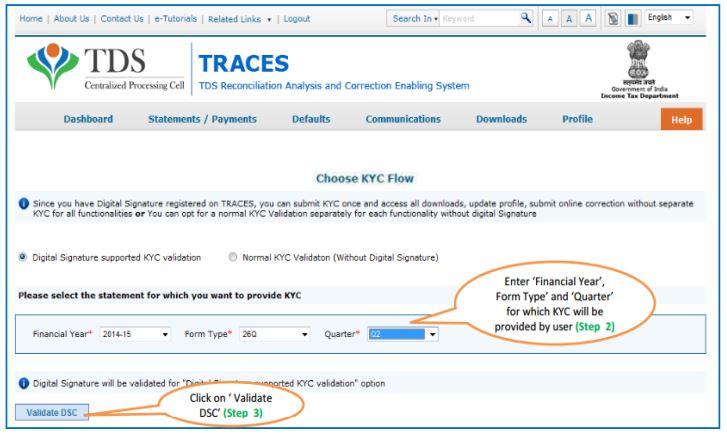

STEP 6: Choose KYC flow for validation

There are two options available for KYC validation:

- Digital Signature Certificate (DSC) – The data related to Financial Year, Quarter and Form Type will be auto-populated. After checking, click on “Validate”. Enter a password of the DSC token click on “OK” and sign the documents using DSC.

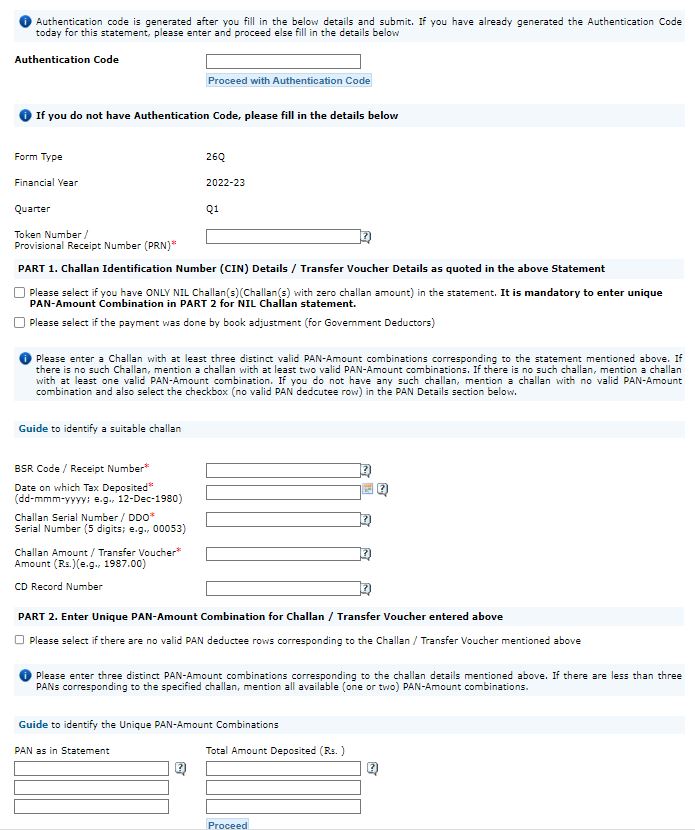

- Without using DSC – Enter the required details, such as:

- The TDS return was filed for the financial year, quarter, form type, and token number.

- Challan details

- PAN and TDS amount.

after filling in the details, Click on “PROCEED”.

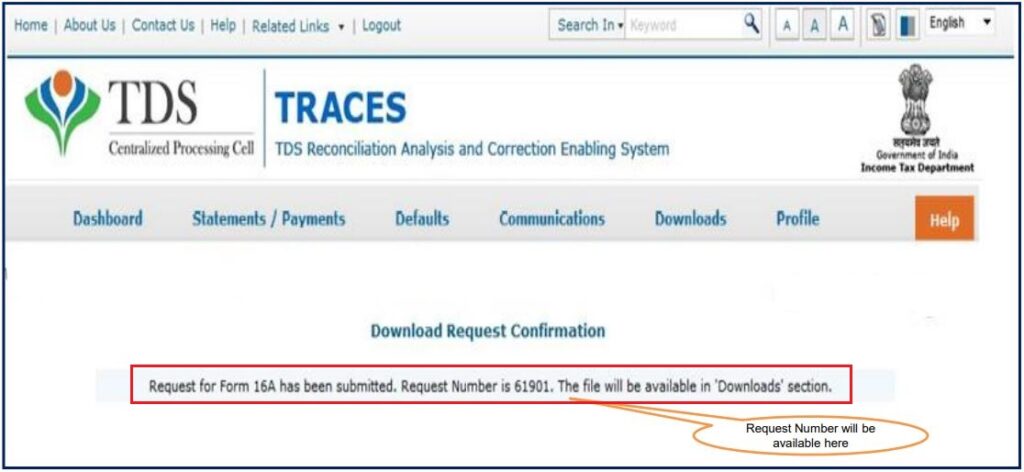

STEP 7: Receipt of confirmation message

After validation of KYC details, a confirmation message will reflect on screen with ‘Request Number’. You can check the status of your request to download Form 16A using this request number.

Please note, that you will be allowed to download Form 16A only if the status is “Available”.

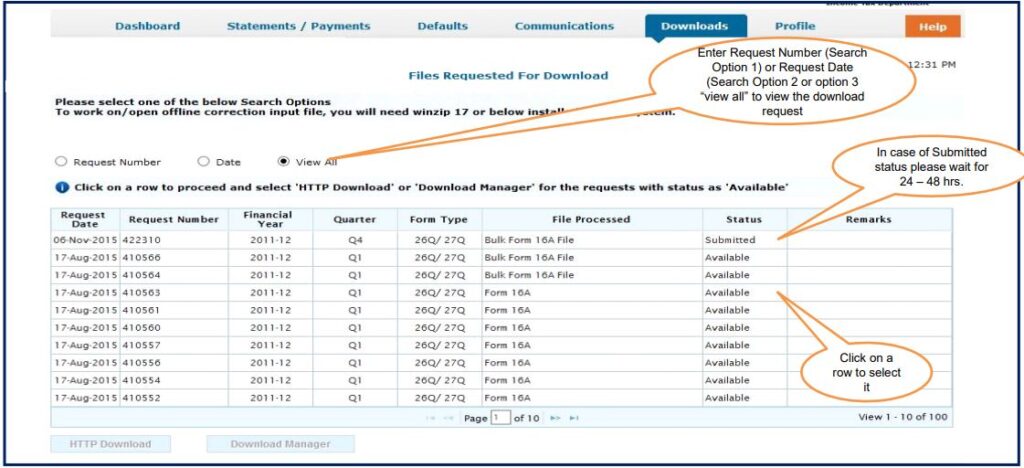

The different statuses for a submitted Form 16A request are:

- Submitted: The request has been successfully submitted and is currently being processed.

- Available: Form 16A is ready for download.

- Disabled: A duplicate request has been made for downloading.

- Failed: The user should reach out to CPC (TDS) for assistance.

- Not Available: The PAN mentioned in the statement is invalid.

STEP 8: Download the form of ‘Available’ status by searching through Request Number, Date or View All.

STEP 9: Download TRACES PDF Converter.

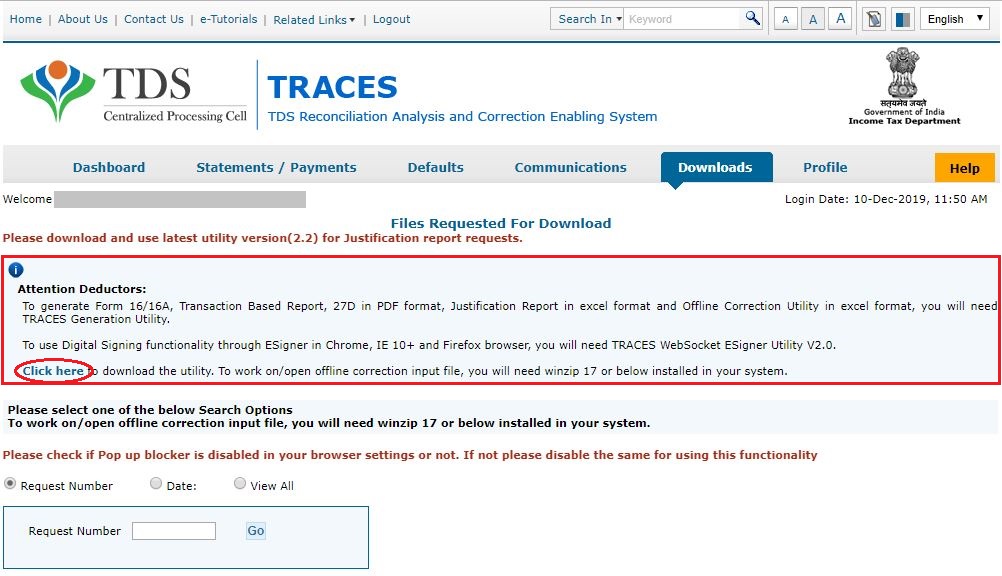

- Go to the Downloads Tab and click on ‘Requested Downloads’.

- Click on the option ‘Click Here’ and enter the captcha code on the directed page.

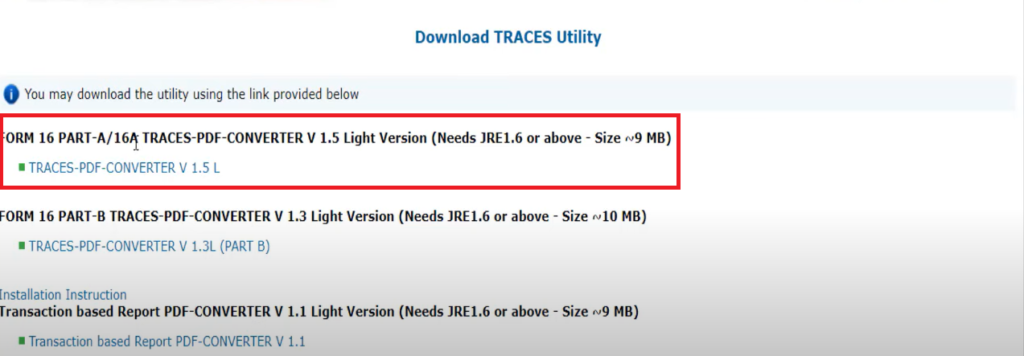

- Now to download the utility, click on TRACES PDF Converter V 1.5 Light Version. This utility will be used to download Form 16A in PDF form.

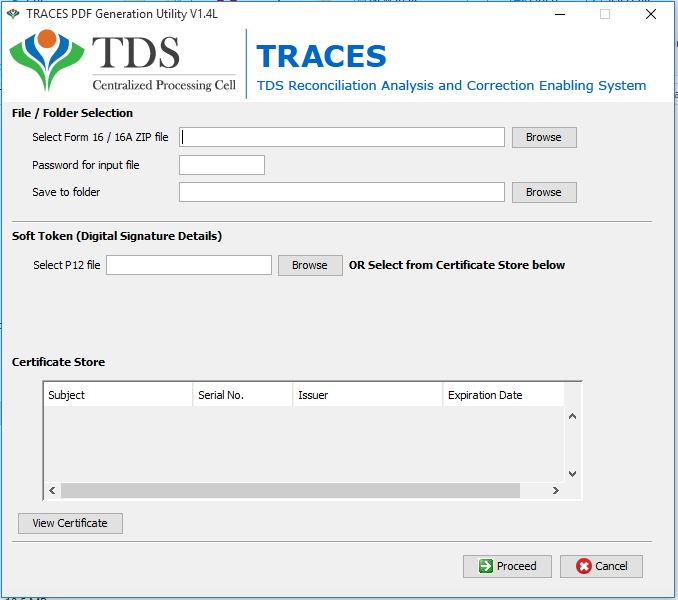

STEP 10: Download the PDF of Form 16A using the utility.

Go to utility > Browse and select the path of the zip folder > Enter a password (TAN) > Select the folder to save the forms > Click on “Proceed”.

Note: Password to open Form 16A is TAN in UPPERCASE i.e. ABCD12345E

By following the outlined steps and ensuring accurate information, Deductor can easily access Form 16A for tax-related purposes.

Frequently Asked Questions

-

What is Form 16A?

Form 16A is a tax certificate issued by a deductor to a taxpayer, indicating the amount of tax deducted at source (TDS) on income other than salary.

-

Who needs Form 16A?

Form 16A is required by individuals and entities receiving income on which TDS has been deducted, such as interest, rent, or professional fees.

-

How can I obtain Form 16A?

You can obtain Form 16A from the deductor’s online portal or request it directly from the deductor if they do not provide it electronically.

-

What information is required to generate Form 16A?

To generate Form 16A, you need the deductor’s details, the taxpayer’s PAN, the amount of income, the TDS amount, and the relevant financial year.

-

Can I generate Form 16A online?

Yes, you can generate Form 16A online through the Income Tax Department’s e-filing portal or the deductor’s online platform.

-

What is the due date for issuing Form 16A?

The due date for issuing Form 16A is typically 15 days after the end of the quarter in which the TDS was deducted.

-

Is it mandatory to file Form 16A with the Income Tax Department?

No, it is not mandatory to file Form 16A with the Income Tax Department; however, it must be issued to the taxpayer for their records.

-

What should I do if I do not receive Form 16A?

If you do not receive Form 16A, you should contact the deductor and request them to issue it, or check their online portal for availability.

-

Can I download Form 16A in PDF format?

Yes, Form 16A can typically be downloaded in PDF format from the deductor’s online portal or the Income Tax Department’s website.

-

How do I rectify errors in Form 16A?

To rectify errors in Form 16A, the deductor must issue a revised Form 16A with accurate details and submit it to the Income Tax Department if necessary.

Read More: What is the difference between Form 16 and Form 16A?

Read More: Form 16A: TDS on Income other than Salary

Official Income Tax Return filing website: https://www.incometax.gov.in/iec/foportal/

Official GST common portal website: https://www.gst.gov.in/

Download Pdf: https://taxinformation.cbic.gov.in/