Important Keyword: Income Tax Compliance, Income Tax Website, IT Notice.

Table of Contents

What is Non-Filing Monitoring System (NMS)?

The Non-Filing Monitoring System (NMS) is a system developed by the Income Tax Department to identify individuals who are required to file taxes but have not done so. Here’s how it works:

Identification of Non-filing

The NMS identifies people who are liable to file taxes—those with an annual income exceeding ₹2,50,000—but have not filed their tax returns. The system leverages several information sources to spot these non-compliant taxpayers:

- AIR (Annual Information Return): Filed by financial institutions, providing details of high-value financial transactions.

- CIB (Centralised Information Branch): Collects and processes data related to potential tax evaders.

- TDS Statements: Details of tax deducted at source, which help in tracking the income of individuals.

Notification Process

Once potential non-filers are identified, the NMS automatically sends a non-compliance email to the taxpayer’s registered email address. The Income Tax Department also sends notifications via SMS and email every year to inform non-filers of their obligation to submit their returns.

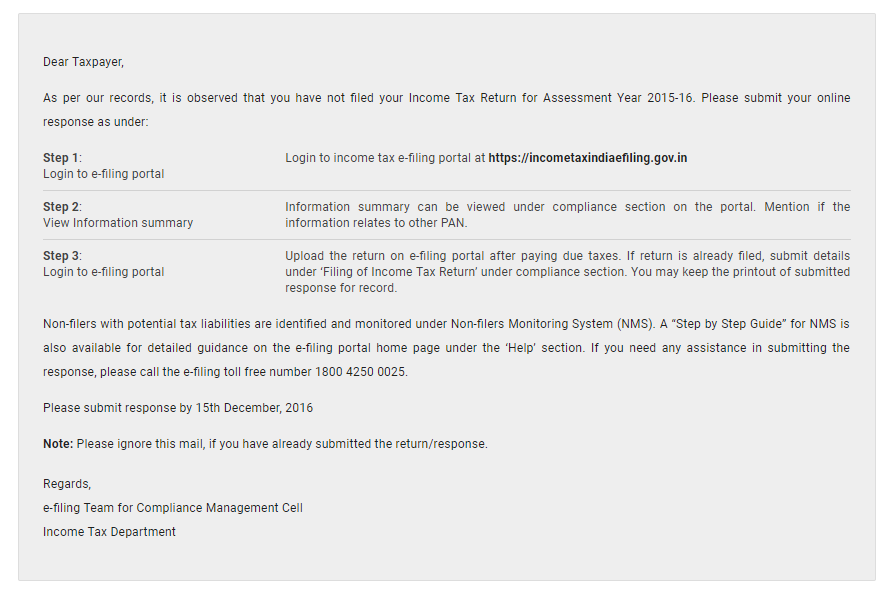

Sample email from Non-filers Monitoring System

How to respond to NMS compliance email?

Here is a step by step guide on how to deal with non-filers monitoring system email

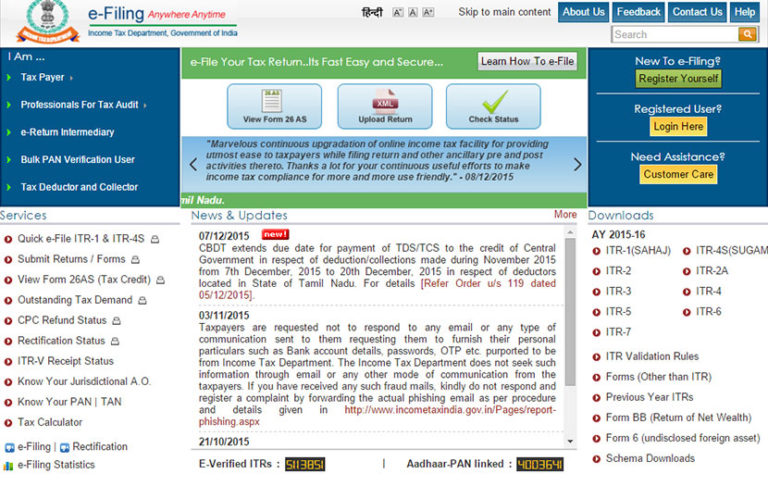

- Visit Income Tax Portal

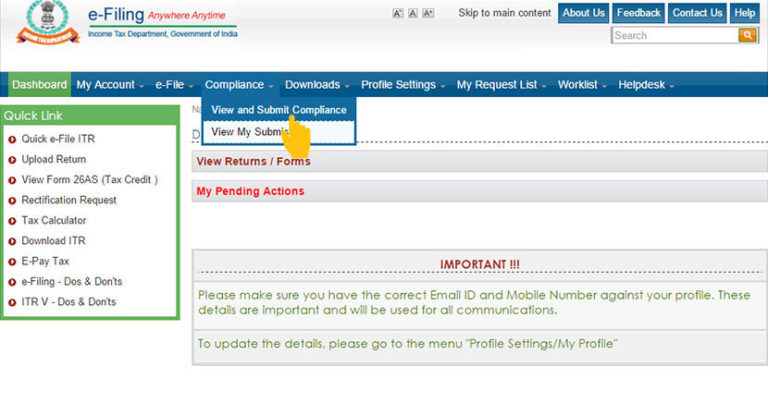

Login Income Tax Website. - Navigate to Compliance

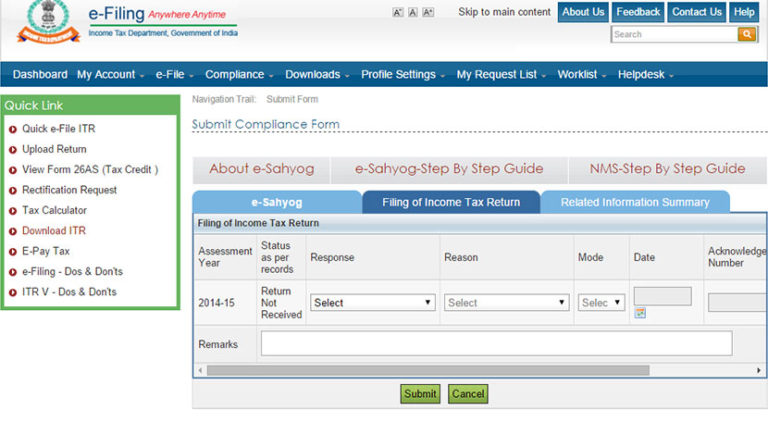

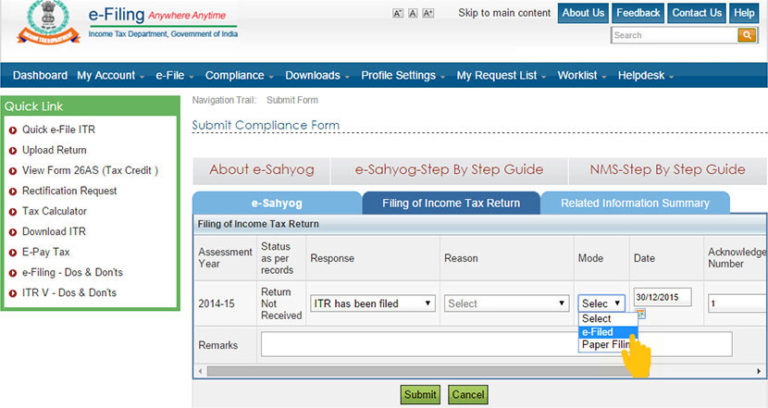

Click on View and Submit Compliance. - You will see the Submit Compliance Form.

Navigate to Filing of Income Tax Return. - Navigate to Asssessment Year for which Return Not Received.

You have two options to respond:

A. ITR has been filed,

B. ITR has not been filed. - If you select option (A), you need to provide:

1. Mode of filing the ITR,

2. Date of filing the ITR,

3. An acknowledgement Number. - If ITR was e-Filed,

details will be prefilled automatically. - If you select option (B), you need to provide one of the following reasons:

1. Return under Preparation,

2. Business has been Closed,

3. No Taxable Income,

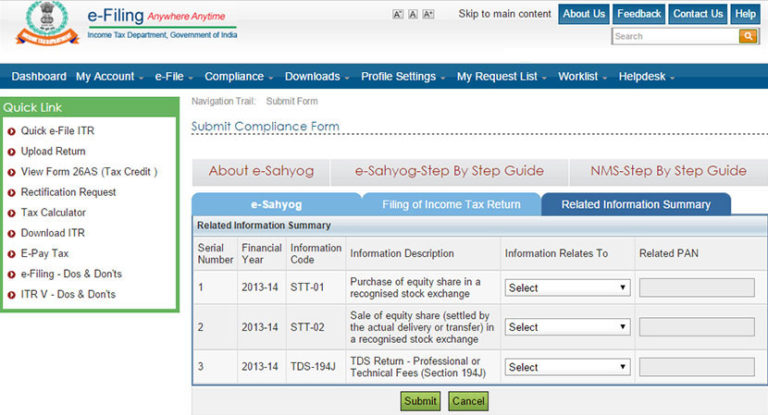

4. Others. - Navigate to Related Information Summary.

It gives a detailed information summary. - Choose a relevant option under Information Related To against each transaction mentioned

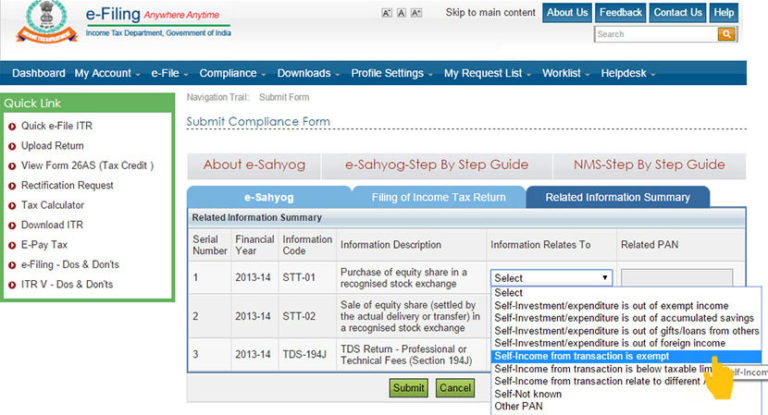

Provide additional information if required. - Following are the options available to a taxpayer under Information Relates To tab:

1. Self-Investment/ expenditure is out of exempt income

2. Self-Investment/ expenditure is out of accumulated savings

3. Self-Investment/ expenditure is out of gifts/ loans from others

4. Self-Investment/ expenditure is out of foreign income

5. Self-Income from a transaction is exempt

6. Income from a transaction is below taxable limit

7. Self-Income from transaction relate to different AY

8. Self-Not Known

9. Other PAN

10. Not Known

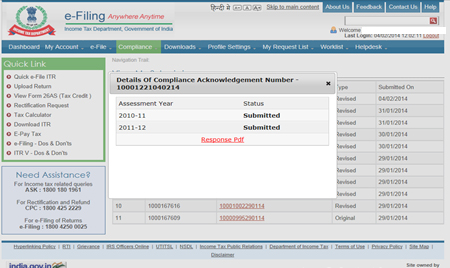

11. I need more information - Upon submission you will see following screen.

Download Response.pdf for your future reference.

Read More: Income Tax Refund: Eligibility, Procedure and Interest

Web Stories: Income Tax Refund: Eligibility, Procedure and Interest

Official Income Tax Return filing website: https://incometaxindia.gov.in/