Important Keyword: Income Tax, Tax Deductions, Filing Income Tax, Income Tax Slabs.

Words: 2674, Read Time: 14 Min

Table of Contents

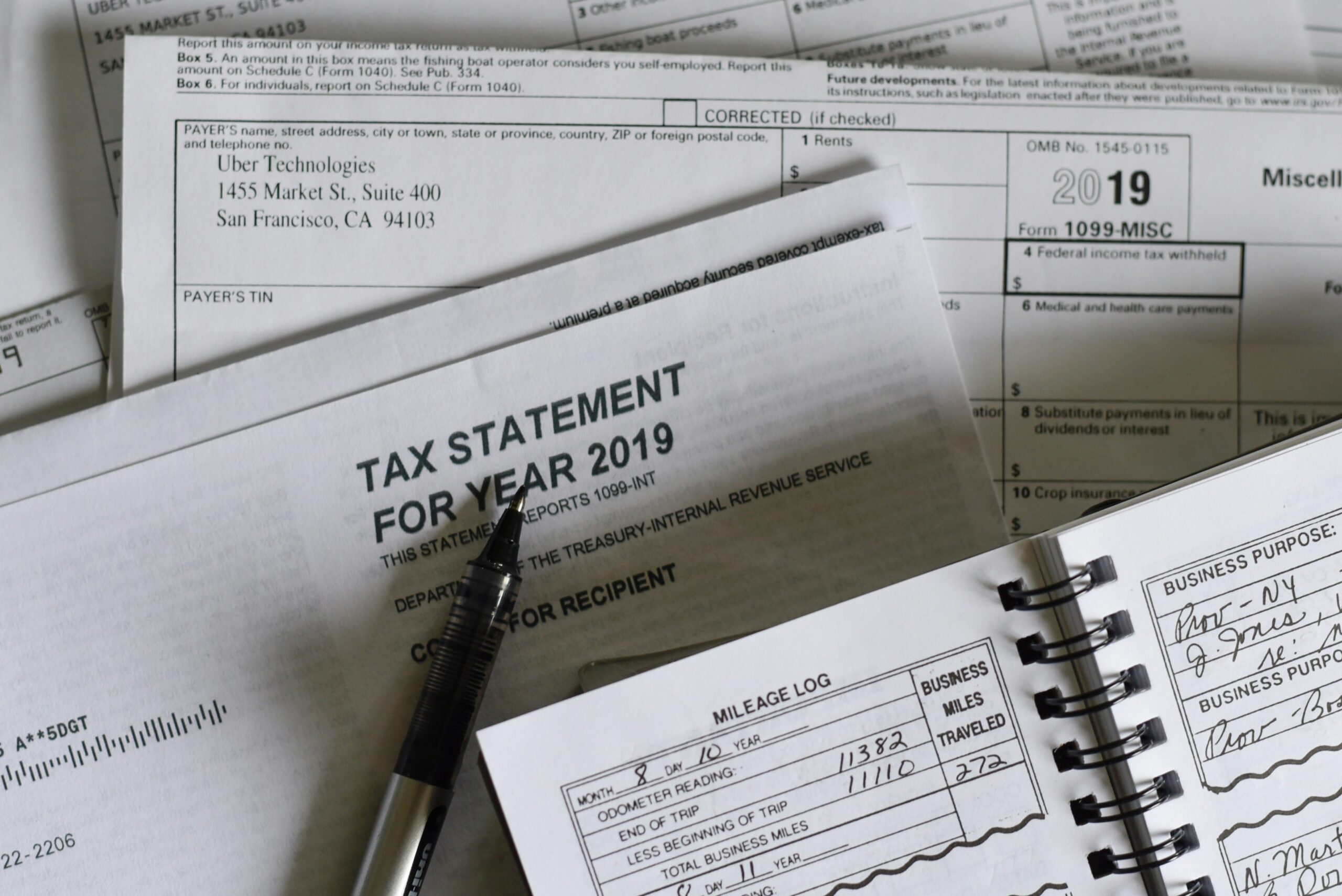

Introduction to Income Tax

Income tax is a financial levy imposed by the government on the income earned by individuals, businesses, and other entities within a specified period, typically a fiscal year. In India, this tax forms a crucial part of the government’s overall revenue system, contributing significantly to the funding of public services and infrastructure projects. The revenues generated from income tax are allocated towards essential areas such as healthcare, education, and social welfare programs, thereby playing a vital role in the country’s economic development and well-being of its citizens.

The significance of income tax extends beyond just revenue collection; it serves as a tool for redistributing wealth within society and promoting equitable economic growth. Through progressive tax structures, where those with higher incomes are taxed at higher rates, the system aims to reduce income inequality and ensure that the affluent contribute a fair share towards the welfare of the less privileged sections of the population.

In India, filing income tax returns is a compulsory obligation for individuals whose annual income exceeds a designated threshold set by the government. This threshold may vary based on a person’s age, type of income, and other determining factors. Tax compliance is not only a legal requirement but also plays a significant role in the overall economic stability of the nation, ensuring that funds are available for public spending. Taxpayers are also entitled to various deductions and exemptions aimed at reducing taxable income, encouraging savings and investments. Thus, understanding income tax regulations is essential for responsible financial planning and compliance in the Indian context.

What is Income Tax?

Income tax is a governmental levy imposed on individuals and corporate entities based on the income they earn within a given financial year. In India, this tax is governed by the Income Tax Act of 1961, and it serves as a principal source of revenue for the government. The taxation structure categorizes income into various brackets, which dictate the rate at which taxpayers are taxed. As per the current regulations, individuals whose annual income exceeds Rs 2,50,000 are required to file an income tax return. This threshold indicates the minimum income level beyond which individuals must adhere to the tax regulations set forth by the Indian authorities.

It is critical to note that taxpayers are obligated to file their returns not only if they owe taxes but also if their taxable income amounts to zero. This requirement stems from the necessity of maintaining transparency in one’s financial dealings and ensuring accurate reporting of all sources of income. The different income categories include salaries, business profits, capital gains, rental income, and any other earnings that contribute to an individual’s total income. Each of these categories must be disclosed while filing tax returns, regardless of whether they result in a tax liability or not.

Moreover, understanding the structure of income tax is paramount for effective tax planning. Various deductions and exemptions are available, which can help in reducing taxable income. As stipulated by the law, the return must be accurately filled and submitted in a timely manner to avoid penalties or legal consequences. Compliance with these regulations ensures that individuals contribute their fair share towards nation-building and facilitates various public welfare projects funded by the collected revenues.

Who is Required to Pay Income Tax?

In India, the obligation to pay income tax is defined by a variety of factors, including income level, age, and the nature of an individual’s financial situation. All individuals whose total income exceeds a prescribed threshold must file an income tax return. For the financial year, this income tax filing window typically extends from April 1 to July 31, requiring taxpayers to submit their returns within this timeframe to remain compliant with the law.

To initiate the tax filing process, individuals must possess a Permanent Account Number (PAN) and, more recently, an Aadhaar card. The PAN serves as a unique identification number for taxpayers and is mandatory for filing income taxes, ensuring that all financial transactions are adequately tracked by the tax authorities. The Aadhaar card, while also essential for various other services, supports identity verification during tax activities, thereby enhancing compliance and reducing fraudulent claims.

The Income Tax Department has established different tax slabs for various categories of taxpayers—namely, individuals under the age of 60, senior citizens aged 60 to 80, and those over 80 years old. Each category has distinct income thresholds before tax liability arises. With these evolving regulations, even individuals receiving income from diverse sources, such as salaries, business profits, or investments—including capital gains—are subjected to regular income tax assessments in India.

It is also critical to note that taxpayers are increasingly being urged to understand the importance of remaining tax compliant. Non-compliance can lead to significant penalties, litigation, and interest on unpaid dues. Thus, familiarity with the eligibility criteria for income tax, filing obligations, and the requisite documentation is vital for all individuals aiming to fulfill their tax responsibilities diligently.

The Process of Filing Income Tax

Filing income tax in India can appear daunting, but following a structured approach simplifies the process significantly. The first step involves downloading the Income Tax Return (ITR) software from the official Income Tax Department website. This software is available in both online and offline formats, allowing taxpayers to choose the one that best fits their needs. It is crucial to select the correct ITR form based on the income sources, so familiarity with various ITR forms is advisable.

Once the software is downloaded, the next step is to calculate your returns. Taxpayers must gather all relevant financial documents, including Form 16, bank statements, and other income-related documents. Utilizing calculators or spreadsheets can help in determining the total taxable income and the applicable tax liability. Transparency is vital at this stage, as accurate reporting ensures compliance with tax regulations.

The ITR software often includes a ‘pre-fill’ option that allows taxpayers to automatically populate certain fields with pre-established data, such as salary and tax deductions, saving time and reducing the likelihood of errors. It is essential to verify this pre-filled data against personal records for accuracy.

Following this, the taxpayer is required to make tax payments, if applicable. Payment can be made online through the same income tax portal, where different payment modes, such as net banking and credit/debit cards, are available. After completing the necessary transactions, it is vital to save all payment receipts, as these documents may be needed for future reference.

Finally, after entering all details and making necessary payments, the next stage involves submitting the ITR. Ensure that all data is double-checked before submission, as mistakes can lead to delays. Once submitted, taxpayers will receive an acknowledgment, which should be kept for record-keeping purposes. This systematic procedure, from downloading the ITR software to submission, provides a comprehensive framework for taxpayers to file their income taxes accurately and efficiently.

Common Pitfalls in Filing Income Tax

Filing income tax can often be a daunting task, with numerous complexities that can lead to errors. One of the most common mistakes individuals make is incorrectly reporting their income. This can occur when taxpayers forget to include sources of income, such as freelance work, rental income, or interest earned on savings accounts. To avoid this pitfall, it is crucial to maintain comprehensive records of all earnings throughout the financial year. By ensuring that all income sources are accounted for, taxpayers can minimize the risk of discrepancies in their tax filings.

Another frequent mistake involves failing to claim eligible deductions. Many taxpayers miss out on valuable deductions related to investments, home loans, or medical expenses. This oversight not only leads to higher tax liability but also diminishes the benefits that can be gained from the tax structure in India. It is advisable for individuals to familiarize themselves with the various deductions and exemptions available under the Income Tax Act. Keeping organized documentation and verifying eligibility can significantly mitigate the risk of such errors.

Additionally, missing deadlines is a prevalent concern among taxpayers. Filing income tax returns post the stipulated due date can result in penalties and interest on outstanding dues. To avoid this, individuals should remain informed about filing deadlines and utilize reminders or calendar alerts in advance. Furthermore, taxpayers should also allow ample time for gathering documents and completing the filing process to prevent last-minute errors.

In summary, awareness of common pitfalls such as incorrect income reporting, missed deductions, and filing deadlines is crucial for ensuring a smooth income tax filing process. By implementing organized practices and thorough reviews of their financial status, individuals can navigate the complexities of income tax with greater confidence.

Tax Deductions and Benefits

Tax deductions play a vital role in reducing the overall tax liability for individuals in India. Under the Income Tax Act of 1961, Section 80C is one of the most significant sections that provide taxpayers with the opportunity to claim deductions for various investments and expenditures, making it a key area for anyone looking to minimize their tax outgo. The maximum amount that can be claimed under Section 80C is ₹1.5 lakh in a financial year.

Several investment instruments qualify for deductions under Section 80C. One of the most popular options is the Public Provident Fund (PPF), which not only offers decent returns over a long period but also provides the benefit of tax deduction for contributions made. Similarly, Equity Linked Savings Schemes (ELSS), which are mutual funds, allow taxpayers to invest in equity markets while enjoying the deduction benefit, along with potentially higher returns.

Other eligible investments include the National Savings Certificate (NSC), five-year fixed deposits with banks, and the Sukanya Samriddhi Account aimed at encouraging savings for girls. Additionally, life insurance premiums paid and contributions to the Employee Provident Fund (EPF) are also covered under this tax deduction section. For instance, if an individual pays ₹50,000 as premium for a life insurance policy and contributes ₹1 lakh to an ELSS, the total deduction that individual can claim would be ₹1.5 lakh, thereby significantly reducing the taxable income.

The effective use of these deductions can lead to a considerable decrease in tax payouts. It is advisable for taxpayers to thoroughly explore the options available under Section 80C and make informed investment choices based on their financial goals, tax liabilities, and future needs. Understanding these deductions enables taxpayers to manage their finances better while availing of the benefits provided by the government.

Real-Life Example of Income Tax Filing

To illustrate the income tax filing process in India, let us consider the case of Mr. Rajesh Kumar, a 35-year-old IT professional living in Bangalore. Mr. Kumar’s income comprises his salary and investment earnings. For the assessment year 2022-23, Mr. Kumar earned an annual salary of ₹8,00,000 and generated a further ₹50,000 from stock market investments. This totals a gross income of ₹8,50,000.

As a responsible taxpayer, Mr. Kumar understands the importance of deductions to lower his taxable income. He avails himself of the deductions under Section 80C of the Income Tax Act, which allows taxpayers to claim a deduction of up to ₹1,50,000 for specified investments. Mr. Kumar invested ₹1,50,000 in the Public Provident Fund (PPF) and made an additional investment of ₹50,000 in National Pension Scheme (NPS), bringing his total eligible deductions under Section 80C to ₹1,50,000. He also claimed ₹25,000 under Section 80D for health insurance for himself and his family.

After accounting for these deductions, Mr. Kumar’s taxable income amounts to ₹8,50,000 – ₹1,50,000 (Section 80C) – ₹25,000 (Section 80D) = ₹7,75,000. With the current income tax slabs in place, his taxes would be calculated as follows: The first ₹2,50,000 is tax-exempt, the next ₹2,50,000 (from ₹2,50,001 to ₹5,00,000) is taxed at 5%, resulting in a tax of ₹12,500, and the next ₹2,75,000 (from ₹5,00,001 to ₹7,75,000) is taxed at 20%, amounting to ₹55,000. The total income tax payable is then ₹12,500 + ₹55,000 = ₹67,500.

Finally, after considering a rebate under Section 87A (which is applicable only if gross taxable income is below ₹5,00,000), Mr. Kumar determined his total liability. He filed his income tax return online through the Income Tax Department’s e-filing portal, thus demystifying the essential yet often complex process of tax filing for an average Indian taxpayer.

Key Insights and Learnings

Understanding income tax in India is crucial for both individuals and businesses as it impacts financial planning and compliance. First and foremost, it is essential to be aware of the income tax obligations that vary based on the individual’s residential status, age, and income brackets. The tax rates are structured into different slabs, encouraging individuals to comprehend these levels to accurately estimate their taxes. The current system differentiates between the regular tax regime and the new optional taxation scheme, which presents varied implications for taxpayers.

Another critical point is the filing process, which is mandated on an annual basis. To file income tax returns, individuals must gather necessary documentation such as Form 16, bank statements, and information regarding income sources, which may include salaries, rental income, or investments. Understanding the timeline for filing returns is essential, as missing deadlines can lead to penalties and interest on unpaid taxes. Individuals can utilize e-filing portals for a more streamlined experience, making compliance easier and more efficient.

Deductions play a significant role in reducing the taxable income, therefore maximizing financial benefits. Various deductions are available under sections like 80C, which covers investments in schemes such as Public Provident Fund and Life Insurance Premiums. Additionally, taxpayers can benefit from standard deductions, housing loan interest, and medical expenses. Awareness of these deductions and how to apply them ensures compliance while optimizing tax liability. Ultimately, gaining a clear understanding of these facets will aid individuals in fulfilling their tax obligations effectively while leveraging available financial strategies.

Conclusion: Staying Compliant and Informed

Understanding income tax is an essential aspect of financial planning for individuals and businesses in India. Proper comprehension of the income tax framework not only aids in filing accurate returns but also ensures one remains compliant with the legal obligations set forth by the government. Non-compliance can lead to significant financial repercussions, including penalties and interest on unpaid taxes, as well as potential legal action. This underscores the importance of being well-versed with tax regulations to avoid such consequences.

Moreover, the landscape of income tax in India is continually evolving, with regular updates and changes to laws affecting various aspects of taxation. It is crucial for taxpayers to stay informed about recent amendments, budget announcements, and policy shifts that may impact their tax liabilities. Engaging with reliable sources of information, such as the official website of the Income Tax Department, tax consultants, and regular financial literacy programs, can provide valuable insights into navigating the complexities of the tax system.

Furthermore, ongoing financial literacy plays a pivotal role in enhancing an individual’s capability to manage taxes effectively. This includes understanding various tax-saving instruments and exemptions available under the Income Tax Act, which can substantially reduce taxable income. By equipping oneself with knowledge about investment options, deductions, and the implications of different income slabs, taxpayers can strategically plan their finances while remaining compliant with the prevailing tax laws.

In conclusion, staying compliant and informed about income tax in India requires a proactive approach. An understanding of the implications of non-compliance, coupled with regular updates on tax regulations, will empower taxpayers to make sound financial decisions, ensuring they navigate their tax obligations confidently.

Download Pdf: https://taxinformation.cbic.gov.in/