Important Keyword: Intimation, IT Notice.

Table of Contents

Income Tax Notice

An income tax notice is a formal letter sent by the Income Tax Department to taxpayers for various reasons. These notices might ask for more information, clarify details in tax returns, remind individuals to file their returns, or notify them about tax audits and assessments. It’s essential for taxpayers to understand what the notice means and to respond quickly by providing the needed information or documents. Ignoring these notices can lead to serious consequences, such as interest charges, penalties, fines, or even legal issues like imprisonment.

Thus, it is very important for taxpayers to be aware of the nature of these notices and to take prompt action to comply with the requests. Proper and timely responses can help avoid complications and ensure compliance with tax laws.

Reasons for issuance of Income Tax Notice

A taxpayer might receive a notice from the Income Tax Department for several reasons. Here are the main factors that often lead to such notices:

- Non-filing of Income Tax Return (ITR)

- Mismatch in Tax Credits

- ITR Filed Without Payment of Tax Dues

- Non-disclosure of Income

- Scrutiny Assessment

These are the usual reasons for receiving a notice, but other unexpected circumstances can also trigger one.

Communication of Income Tax Notice

The Income Tax Department sends notices via email or text messages. If they find errors or discrepancies in your return, they will notify you on your registered email ID and mobile number.

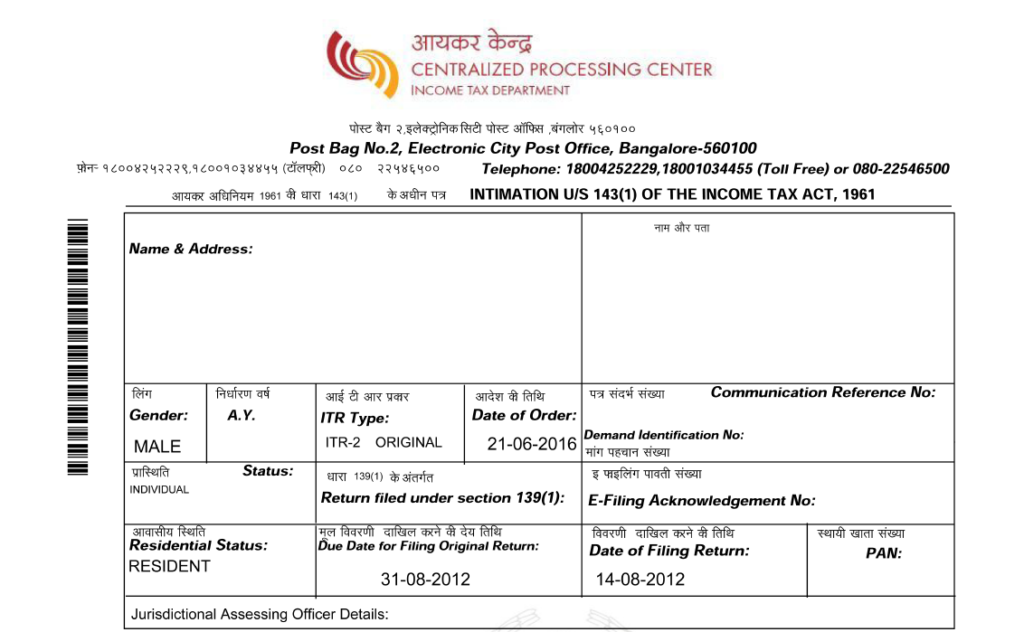

Identifying the Validity of the Income Tax Notice

Before responding to an Income Tax notice, it’s crucial to verify its authenticity and ensure that it is indeed intended for you. This step helps in preventing any potential fraud or miscommunication. This can be done by carefully checking the basic details outlined in the sample notice below:

When you receive an income tax notice, it’s essential to verify its details to ensure it is accurate and intended for you. Here’s what you need to check:

- Name and Address: Make sure the notice has your correct name and address.

- PAN Number: Verify that your Permanent Account Number (PAN) is correctly mentioned.

- Assessment Year, Type of Return, ITR Type: Confirm these details are correct and match your tax filing.

- Name and Designation of the Issuing Officer: Check the credentials of the officer who issued the notice.

- Communication Reference Number: Note this number for any further correspondence or inquiries.

Accessing the Notice

Most income tax notices are password protected. To open the notice, you will need to use a specific format for the password:

- Password: Your PAN in lowercase followed by your date of birth in DDMMYYYY format, without any spaces.

- Example: If your PAN is AAAPA1234A and your date of birth is January 1, 2000, the password will be

aaapa1234a01012000.

Example:

- PAN: AAAPA1234A

- Date of Birth: 01/01/2000

- Password:

aaapa1234a01012000

Common reasons for Notice and their resolution

| Section | Reason for Notice | Resolution |

|---|---|---|

| 139(9) | For filing a defective return | Identify the defect mentioned and submit a return in response to the notice of defective return notice u/s 139(9). |

| 142 | For not filing the income tax return or for the scrutiny of documents & accounts in support of the return filed. | File the return within the time limit mentioned in the notice. Submit a valid response if you are not required to file a return. Present before the assessing officer with books of accounts and supporting documents if demanded by the Assessing Officer. |

| 143(1) | For adjustment or additional tax demand if an error or incorrect information is detected in the return. | Pay outstanding tax dues if any. Correct the errors and file rectification return u/s 154 if required. |

| 143(2) | For scrutiny assessment after a detailed inquiry by assessing officer. | Your case has been selected for scrutiny. Hence, you should provide all the relevant information, pieces of evidence as demanded by IT authorities. |

| 148 | For reassessment, if the officer believes some income has escaped assessment. | Provide all the relevant information, evidence as demanded by IT authorities. |

| 156 | For dues (tax, interest, penalty, fine or any other sum) payable by the assessee) | Submit a response to a notice from e-Filing account. Pay tax if you agree. Provide a reason if you don’t agree with the demand. |

| 245 | For adjustment of a refund with any demand due | For dues (tax, interest, penalty, fine, or any other sum) payable by the assessee) |

Dealing with an Income Tax Notice

Don’t Ignore the Notice

When you receive an income tax notice, it’s crucial not to ignore it. Verify the details and respond promptly within the specified period. Failing to respond can lead to penalties and other consequences.

Check the Notice for Your Basic Details

Ensure the notice includes correct information such as your PAN, name, assessment year, assessing officer, and income tax ward details. Make sure there are no errors or ambiguities.

Identify the Reason for the Notice

Review the notice to understand why it was issued. Common reasons include discrepancies in TDS (Tax Deducted at Source), defects in the tax return, or undisclosed information.

Check the Validity of the Notice

The Income Tax Department follows specific time limits for issuing notices. Check the section mentioned in the notice to determine if it was issued within the valid timeframe. For example, a notice under Section 143(3) for scrutiny assessment must be issued within nine months of the end of the financial year in which the return was filed. If the notice is issued later, it may be invalid.

Provide Supporting Evidence

You may be asked to provide documents and information to support your response. Gather the necessary documents to back up your claims or explanations.

Timely Response

Respond to the notice within the period mentioned. If you are unable to gather the required documents or information in time, communicate this to the department and request an extension.

Seek Professional Help

If you don’t understand the notice, seek help from a professional, such as a Chartered Accountant.

How to Respond to the Notice

- Verify Details and Reason: Ensure the notice is valid and understand the reason for its issuance.

- Log into the Income Tax Portal: Access the portal to respond to the notice.

- Attach Supporting Documents: Provide any requested documents or information related to your filed return.

- Submit Your Response: Ensure you submit your response within the stipulated time frame.

For submitting a response, the taxpayer can follow below-mentioned steps:

- Login to the e-filing portal and Navigate to Pending Actions > E-Proceedings from the dashboard.

- Download Notices

Click on the option to View Notice option for the notice on which the taxpayer wants to submit the response. Once the tab is opened taxpayer can download the notice. For example, here we are selecting 143(1) adjustment notices.

- Respond to Notice

Click on the option to submit a response for responding.

- Proceed to e-verify your response

Once the taxpayer responds to the notice, they are required to e-verify the provided response for submitting it.

- Successful Verification

On successful e-verification, a success message will be there along with a Transaction ID. You will also receive a confirmation message on your email ID registered on the e-filing.

Consequences of non-response

The taxpayer must furnish a response to the notice within the stipulated time frame mentioned in the notice. Failure to do so may result in the department imposing penalties, interest, or fines. Additionally, in certain cases, the department may specify provisions for imprisonment.

Read More: Income Tax Refund: Eligibility, Procedure and Interest

Web Stories: Income Tax Refund: Eligibility, Procedure and Interest

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments