Important Keyword: Foreign Citizens PAN, Form 49AA, PAN Application, UTIITSL.

Table of Contents

PAN Application (Form 49AA) for NRI on UTIITSL

A Non-Resident Indian (NRI) is an Indian citizen who has spent significant time overseas. According to Indian law, a person is considered an NRI if they have stayed outside India for more than 120 days in a financial year. Additionally, if an individual has been in India for more than 60 days in the current year and 365 days over the four preceding years, they are considered a resident.

Steps to Apply for PAN Card for NRI

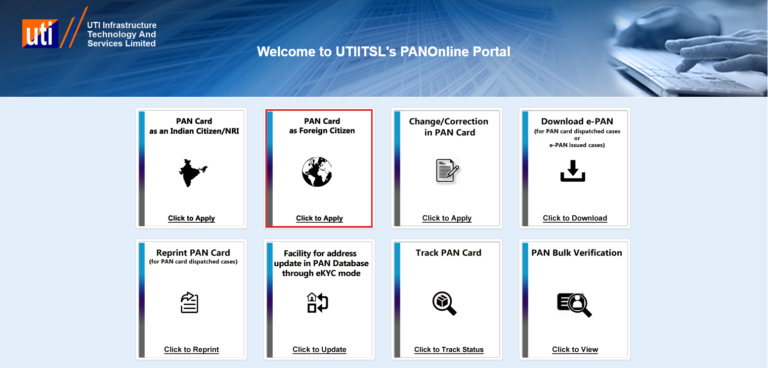

- Visit the UTIITSL portal

Visit the UTIITSL portal to start the process - Select “For PAN Cards > Apply PAN Card“

Click on the “For PAN Cards > Apply PAN Card” option from the dashboard.

- Select “PAN Card as Foreign Citizen“

Click on the “PAN Card as Foreign Citizen” option.

- Click on the “Apply for New PAN Card (Form 49AA).”

Hence, of the four options given, click on the “Apply for New PAN Card (Form 49AA).” You can also download the blank PAN Form (49AA) by clicking on the fourth option.

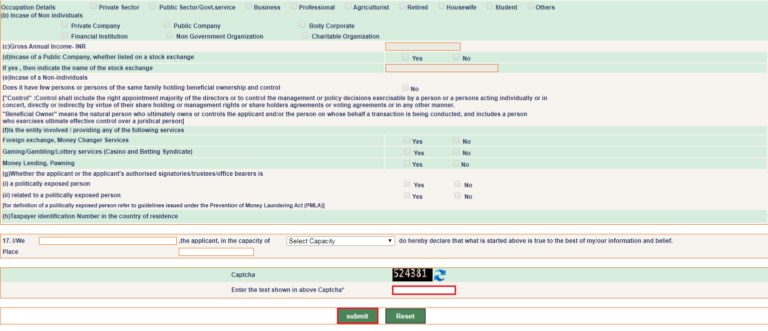

- Fill up all the details required for applicant

Thus, we move to the Form 49AA page. Fill up all the details required in the respective fields. - Enter the captcha code and then “Submit” .

Finally, enter the captcha code from the image given and click on the “Submit” option.

After submitting the Form 49AA, it will redirect you to the payment page. Upon successful completion of the payment process, the process of the PAN card will be initiated.

Read More: AY 2021-22 ITR 1 SAHAJ Form – Salaried Individuals

Web Stories: AY 2021-22 ITR 1 SAHAJ Form – Salaried Individuals

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments