Important Keyword: Change/Correction PAN, Form 49A, PAN Application, UTIITSL.

Table of Contents

UTIITSL: Change/Correction in PAN

The Permanent Account Number (PAN) is a crucial identity proof in India, so it is important that all the information on your PAN card is correct. Sometimes, however, the details on the PAN card may be incorrect or outdated. If this happens, you can apply for corrections or changes to your PAN card through the UTIITSL portal.

There are also instances where people end up with more than one PAN. For example, if someone loses their PAN card and wants to get a new one, but their address has changed, they might apply for a new PAN card instead of updating the address on the old one. This can result in the person having two PAN cards, and they will need to surrender the duplicate PAN card to avoid complications.

Steps to Apply for Change/Correction in PAN

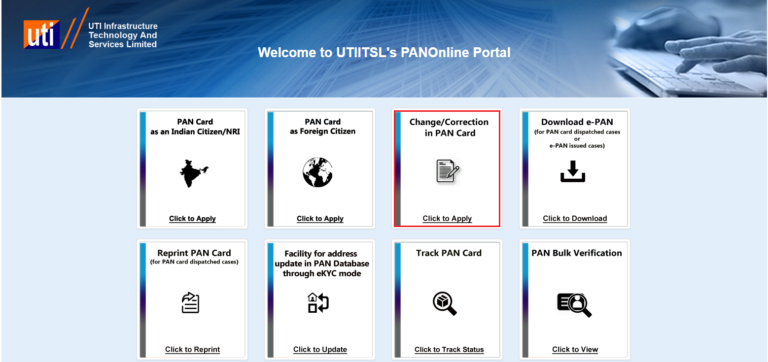

- Visit the UTIITSL portal.

Open the UTIITSL portal first to start the process - Select For PAN Cards > Apply PAN Card.

Click on the For PAN Cards > Apply PAN Card option from the dashboard.

- Select “Change/Correction in PAN Card“.

Click on the “Change/Correction in PAN Card” option to select it.

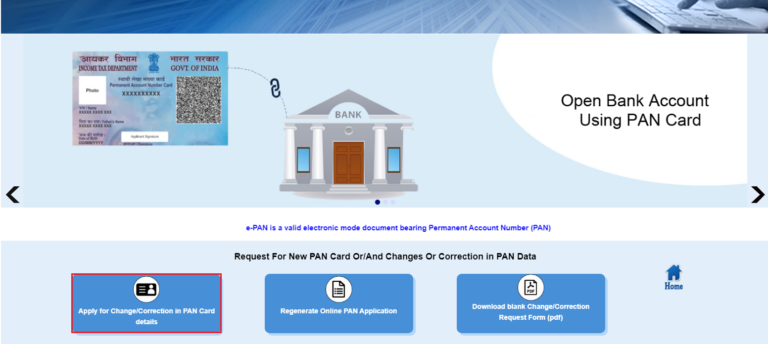

- Select “Apply for Change/Correction in PAN Card Details“

Click on the “Apply for Change/Correction in PAN Card Details” option. You can also download the Change/Correction Request form by clicking on the 3rd option.

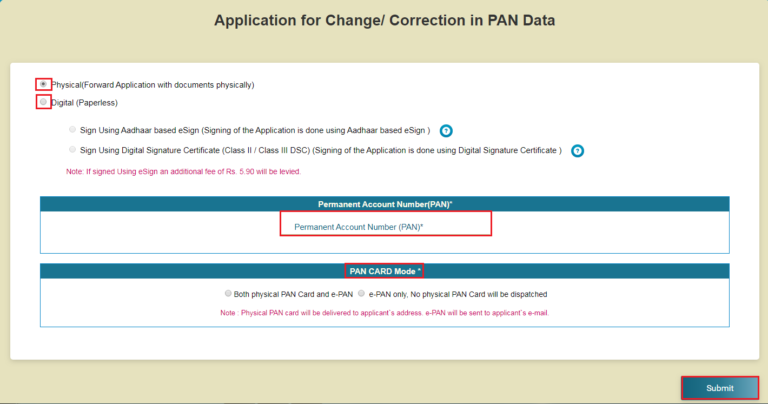

- Select the form of forwarding the documents

Hence, we move to the application page. Select the form of forwarding the documents by clicking on the respective check-box and enter your PAN number. - Select the mode of PAN card & Submit

Additionally, select the mode of PAN card you would like to receive. (e-PAN and/or Physical PAN Card). Thus, click on the “Submit” option.

- Enter the details under the “Personal Details” section and click on the “Next” option

Therefore, a reference number will be given to you which shall be used for future reference until the application number is generated. Hence enter the details under the “Personal Details” section and click on the “Next” option at the bottom of the page.

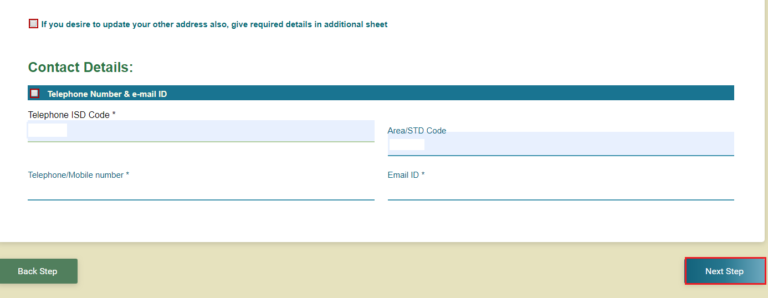

- Fill in the required details in the “Contact Details” section and click on the “Next“.

Hence, we move to the “Contact Details” section. Fill in the required details and click on the “Next” option.

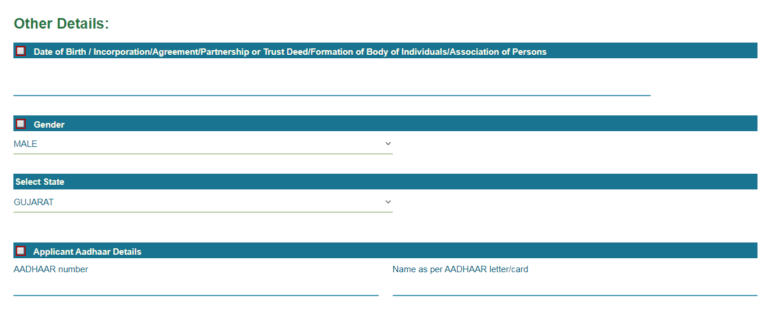

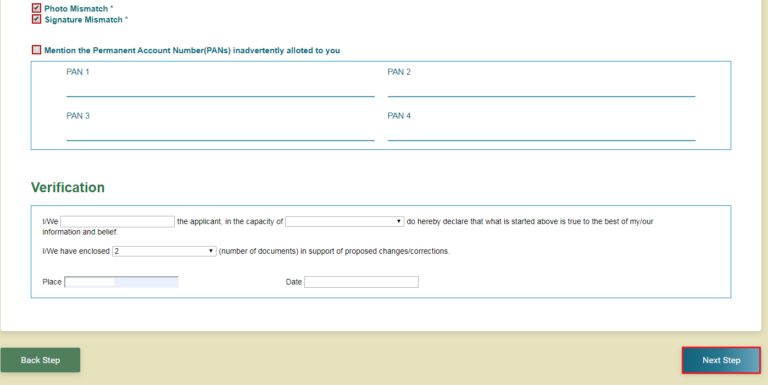

- Fill in the required details in the “Other Details” section and click on the “Next“.

Hence, we move to the “Other Details” page. Enter the details and click on the “Next Step” option.

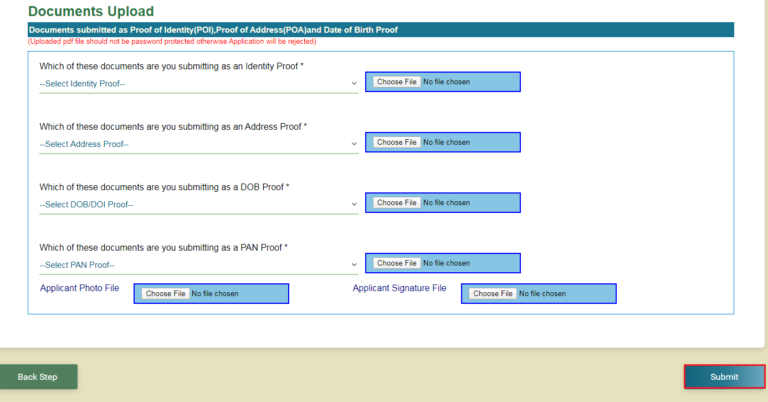

- Upload all of your supporting documents & click on the “Submit” option

Finally, we move to the “Upload” page. Here, you are supposed to upload all of your supporting documents. Once this process is done, click on the “Submit” option to continue.

- Make Payment

After completing the above process, you will be directed to the payment gateway. Upon successful completion of the payment, the process of change or correction in the PAN card will be initiated.

Read More: PAN Application (Form 49AA) for NRI on UTIITSL

Web Stories: PAN Application (Form 49AA) for NRI on UTIITSL

Official Income Tax Return filing website: https://incometaxindia.gov.in/

Circular No. 231/25/2024-GST: Clarification on availability of input tax credit in respect of demo vehicles.

Circular No. 230/24/2024-GST: Clarification in respect of advertising services provided to foreign clients.

Circular No. 229/23/2024-GST: Clarification regarding GST rates & classification (goods) based on the recommendations of the GST Council in its 53rd meeting held on 22nd June, 2024, at New Delhi –reg.

0 Comments