Important Keyword: PAN Address, PAN Application, Update PAN.

Table of Contents

UTIITSL: Update Address on PAN Card

When you file your Income Tax Returns (ITR), the Income Tax Department (ITD) relies on the information from your PAN card to automatically fill in certain sections of the ITR forms. While the PAN card itself doesn’t display your address, the Income Tax Department maintains a record of it, which they use for such purposes. Furthermore, the PAN card serves as a valid proof of identity, making it crucial that all the information on it is accurate.

If there are any inaccuracies on your PAN card, it could potentially cause issues in the future. Specifically, if your PAN card was issued through the UTIITSL portal, you’ll need to submit a request through the same portal to update your address. This ensures that your PAN card reflects the correct information and avoids any complications during tax filing or other official transactions.

Steps to Update Address on the PAN Card

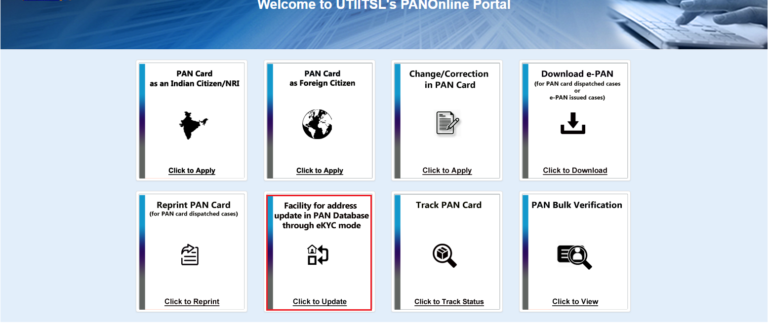

- Visit the UTIITSL Portal.

Click on the For PAN Cards > Apply PAN Card option from the dashboard ON UTIITSL Portal.

- Click on the “Facility for address update in PAN database through eKYC mode” option.

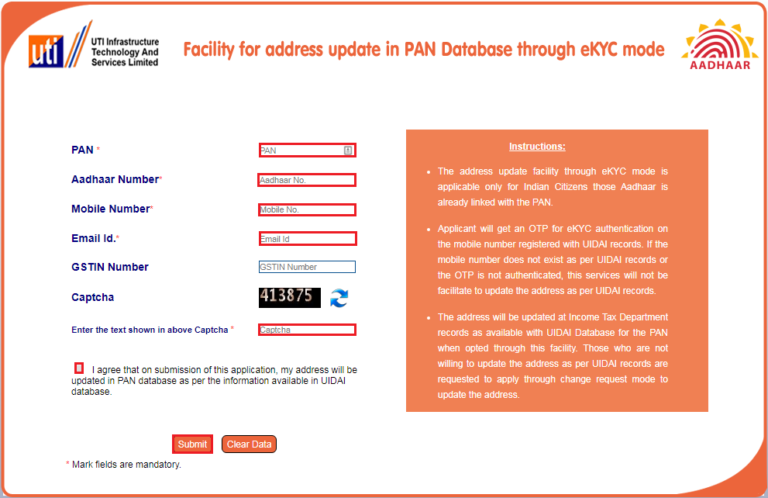

This takes us to the Application page

- Enter the following details in the respective fields:– PAN Number

– Aadhaar Number

– Mobile Number

– e-Mail Address

– GSTIN Number (Optional) - Enter the Captcha code from the image given

And click on the “Submit” option after clicking on the check-box.

- Finally, you will receive an OTP for e-KYC authentication on your registered mobile number.

Thus, it is important to update the PAN card with the most recent or current information.

Read More: UTIITSL: Apply for Reprint of PAN Card

Web Stories: UTIITSL: Apply for Reprint of PAN Card

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments