Important Keywords: Form 49A, PAN Card Application, TIN NSDL.

Table of Contents

PAN Card Application Process on TIN-NSDL portal

The Permanent Account Number (PAN) serves as an alphanumeric identification card issued by the Income Tax Department (ITD) to individuals upon application. The TIN-NSDL portal offers an online platform for PAN card application, providing convenience through internet-based services. However, applicants also have the option to apply offline.

There are two primary types of PAN applications:

- Application for PAN Allotment: This application is utilized when the applicant has never applied for a PAN or does not possess an allotted PAN. Indian citizens, including those residing outside India, can fill Form 49A for this purpose. Foreign citizens seeking a PAN are required to submit Form 49AA.

- Application for New PAN Card or Changes/Corrections in PAN Data: This application is for individuals who already possess a PAN card but require a new one or need to rectify or update information on their existing card. Both Indian citizens and foreign nationals can file this form to request a new PAN card or make necessary alterations to their PAN details.

Steps to Apply for PAN Card Application on NSDL Website

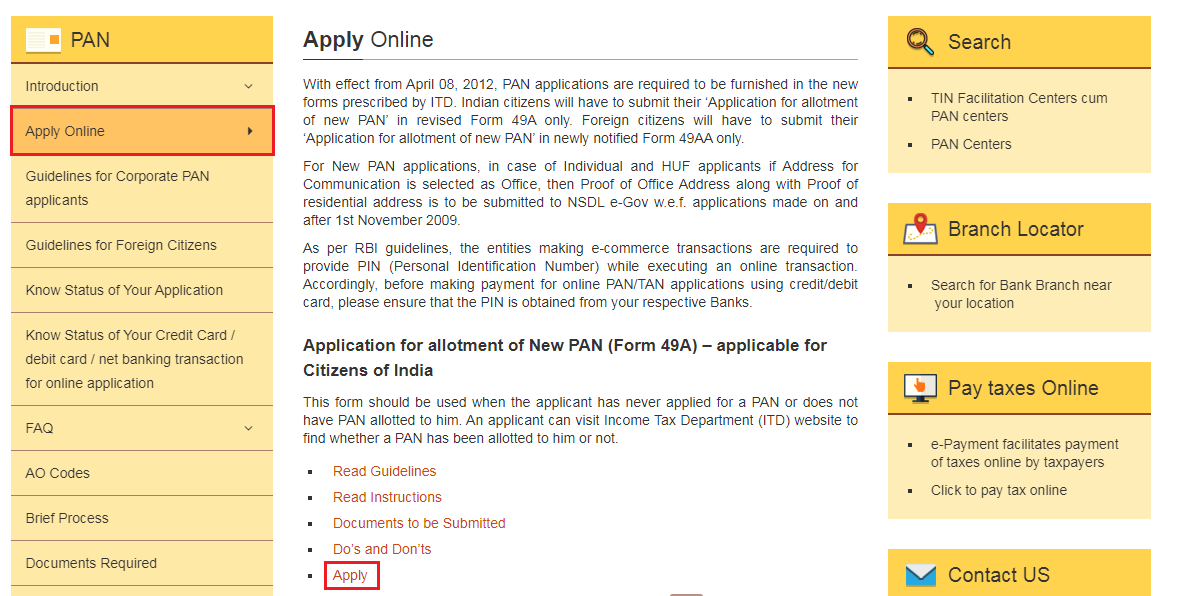

- Visit the TIN-NSDL portal.

Click on the Services > PAN option from the dashboard of the TIN-NSDL portal

- Click on the “Apply” option.

As discussed earlier, Form 49A is for the citizens of India, and Form 49AA is for the foreign citizens.

- Fill in the following details manually or select the options from the drop-down list as required:

1. Application Type

2. Category

3. Title

4. Last Name/Surname

5. Date of Birth (D.o.B)

6. e-Mail ID

7. Mobile Number

8. Captcha Code (from the image given) - Click on the “Submit” option

Once the required details are filled in, click on the “Submit” option.

- Click on the link to continue your PAN Application process

Hence, a token number will be generated. You will be required to click on the link to continue with your PAN Application.

- Thus, we move to the “Personal Details” page. You will have to choose from one of the following options given to you:

1. Submit digitally through e-KYC and e-Sign

2. Submit scanned images through e-Sign

3. Forward application documents physically - Hence, after filling in the required details we move to the “Contact and other Details” section.

Furthermore, you will be given an option to obtain the physical card. If you wish to not go for the physical card, it is mandatory to enter your e-Mail ID as you’ll receive the digitally signed e-PAN card.

- Select the appropriate check-box from the given sections.

Select the appropriate options from the “Source of Income” and “Address for Communication” sections.

- Enter the appropriate country code (ISD Code) under the “Telephone Number & Email ID Details” section.

The other mandatory fields will be pre-filled. Thus, click on the “Next” option.

- We move to the “AO Code” section.

Fill in the following details in the respective field to receive the AO details:

1. Applicant type

2. State

3. City

- Therefore, fill in the appropriate details of the AO in the respective field and click on the “Next” option. We move to the “Document Details” page.

The following supporting documents have to be submitted:

1. Proof of Identity

2. Proof of Address

3. Proof of D.o.B - Choose the type of applicant from the drop-down list.

Fill in the details under the “Place” tab and click on the “Submit” option.

- Submit the documents mentioned below if you have chosen the “Submit digitally through e-KYC and e-Sign” option after step 8,

1. Digital Photo

2. Digital Signature

3. Supporting Documents

To check the status of your PAN Card Application, you’ll need the acknowledgment number received after successfully applying for your PAN and completing the fee payment. Once you have this acknowledgment number, you can track the status of your PAN card.

After the payment process is complete, it typically takes around 15-20 days for the Income Tax Department to process your application and issue the PAN card. If you’re eager to monitor the progress of your application, you have the option to track your PAN card status as well. This allows you to stay informed about the status of your PAN card delivery and any updates regarding your application.

Documents Required for HUF PAN Card Application

For obtaining a PAN Card Application for a Hindu Undivided Family (HUF), the following documents are typically required:

Photo Identity Proof of Karta: This can be any valid photo identity proof of the Karta of the HUF, such as Aadhaar card, Driving License, Passport, etc.

Address Proof: A valid address proof is necessary for the HUF. Acceptable documents include Aadhaar card, Passport, Electricity Bill, Bank Statement, etc.

Date of Birth Proof of Karta: Proof of the Karta’s date of birth is essential. Documents such as Aadhaar card, Driving License, Passport, School Leaving Certificate, etc., can be submitted for this purpose.

Affidavit by the Karta: An affidavit by the Karta of the HUF stating the name, father’s name, and address of all the coparceners is required. This affidavit serves as a declaration of the details of the coparceners within the HUF.

Other Supporting Documents: Additionally, any other supporting documents requested by the authorities may need to be provided. These documents may vary depending on the specific requirements or circumstances of the application.

Read More: Apply for Change/Correction in PAN on TIN-NSDL Portal

Web Stories: Apply for Change/Correction in PAN on TIN-NSDL Portal

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments