Important Keyword: Duplicate PAN, PAN, PAN Application, Reprint PAN, TIN NSDL.

Table of Contents

Reprint/Duplicate PAN Card Application on TIN-NSDL portal

The Income Tax Department (ITD) issues what’s called a Permanent Account Number (PAN), which is essentially an alphanumeric ID in card form. This PAN is provided to individuals who apply for it or to those to whom the department assigns the number without a formal application. If a taxpayer happens to lose or damage their PAN card, they typically apply for a reprint or a duplicate through TIN-NSDL. It’s essential to note that in this process, the taxpayer receives a new PAN card, not a new PAN number. This means there’s no need to go through the hassle of applying for an entirely new PAN card, just a replacement for the lost or damaged one.

Steps to Apply for a Reprint/Duplicate PAN Card

- Visit the TIN-NSDL portal.

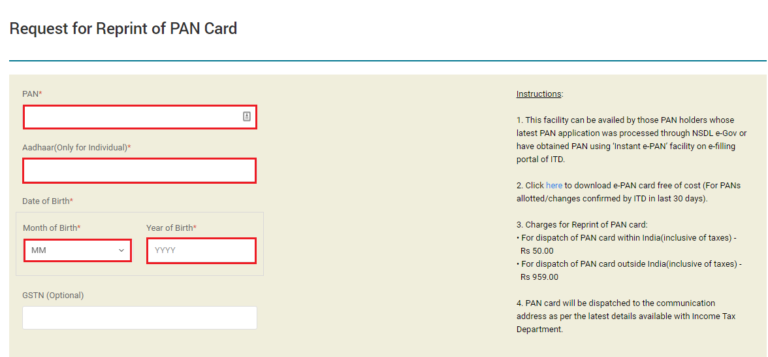

Go to “Reprint of PAN” on Home Page. - After accessing the application form for “Reprint of PAN” enter in the following details

PAN Number, Aadhaar (Only in the case of individuals), Date of Birth (D.o.B).

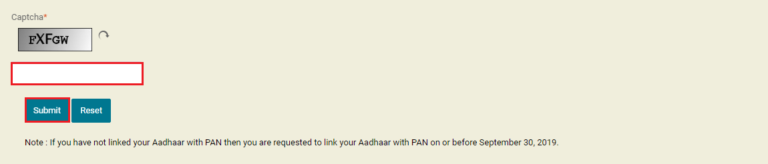

- Enter the Captcha code from the image given below

and click on the “Submit” option.

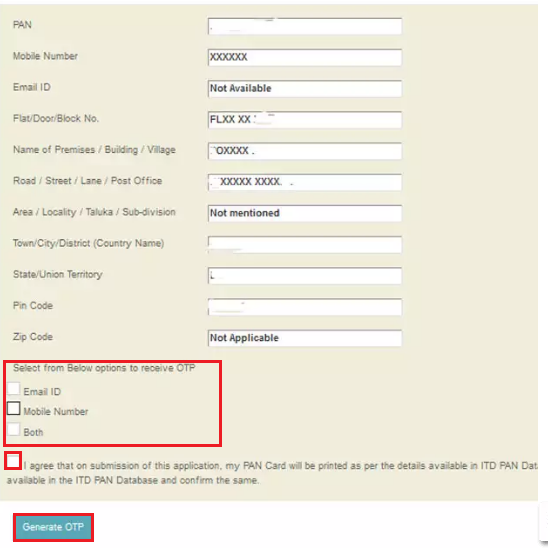

- Verify the personal information shown on screen.

And choose from the below options to receive the OTP:

e-Mail ID

Mobile Number

Both - Select the check-box.

And click on the “Generate OTP” option

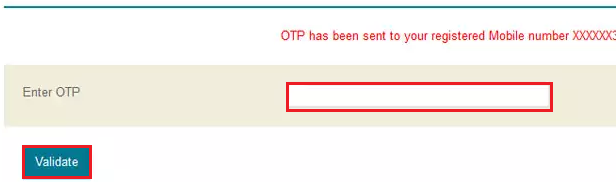

- Enter the OTP received in the respective field.

Click on the “Validate” option.

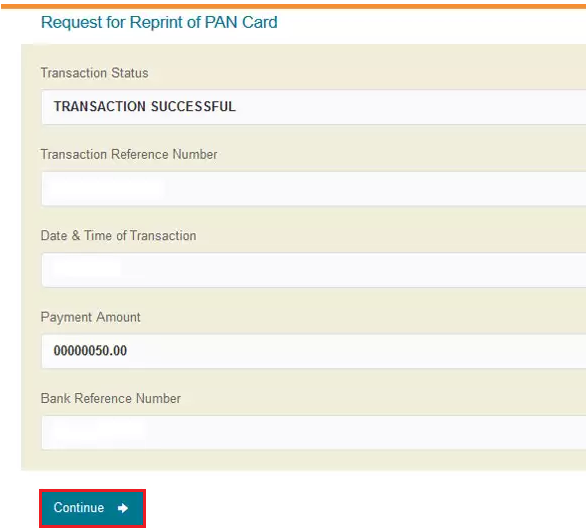

- Make Payment of Fees.

Click on the “Continue” option to generate and print the payment receipt.

Hence, an SMS will be sent on your registered mobile number with your acknowledgment number. The SMS will also provide you the link to download your e-PAN. Moreover, individuals can use this facility only if there is no change in the data such as name, address, etc. Remember you cannot update your details in the PAN using this facility.

PAN card will be dispatched to the communication address as per the latest details available with the Income Tax Department (ITD).

Read More: Check PAN Card Application Status on NSDL

Web Stories: Check PAN Card Application Status on NSDL

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments