Important Keyword: PAN, PAN Application, TIN NSDL, Update Address.

Table of Contents

Update PAN Address on TIN-NSDL Portal

In India, the Permanent Account Number (PAN) carries significant weight, serving not only as a crucial identifier for income tax matters but also as a vital proof of identity. Any inaccuracies in your PAN information could potentially cause complications down the line. Therefore, it’s advisable to ensure that your PAN details are kept up to date.

Taxpayers have the option to update their PAN address details via TIN-NSDL using Form 49A. This straightforward process allows individuals, both citizens and non-citizens of India, to apply for changes or corrections in their PAN information through TIN-NSDL. By keeping your PAN details current and accurate, you can avoid potential issues and ensure smooth interactions with various financial and governmental entities.

Steps to Update PAN Address on TIN-NSDL

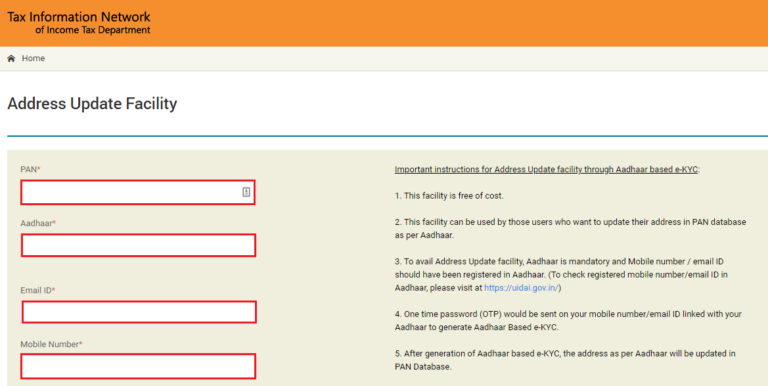

- Visit the TIN-NSDL portal to update the Address on the PAN.Click on “Paperless Address Update in PAN”.

- Enter the following details in the respective fieldsPAN Number, Aadhaar Number, Email ID, Mobile Number

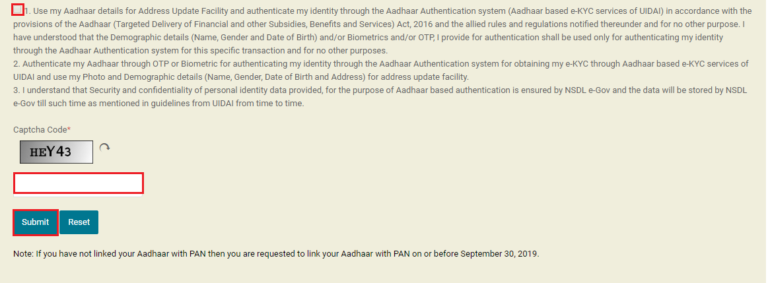

- Click on the check-box.

Enter the captcha code from the given image. Click on the “Submit” option.

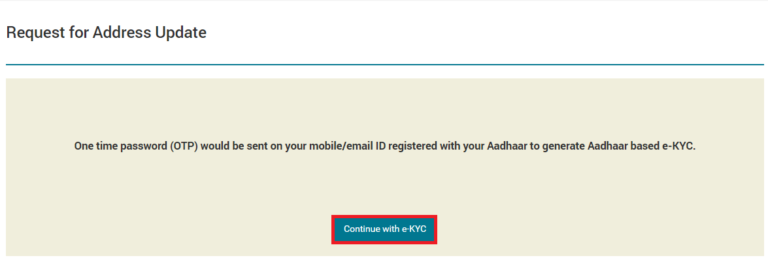

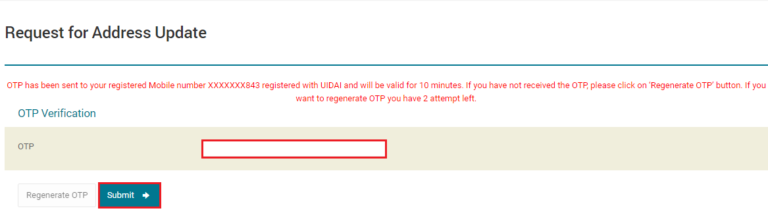

- Hence, the e-KYC page. The mobile number linked to your Aadhaar will receive an OTP.

Click on “Continue with e-KYC”.

- Enter the OTP received.

And click on the “Submit” option.

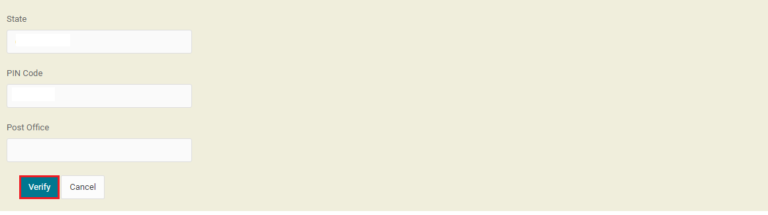

- Click on the “Verify” option.

This will update the address details entered in application.

Once you’ve successfully updated your address in the PAN database, you’ll receive an intimation confirming the change. This notification will be sent via message to the mobile number and email address provided by you during the process. Additionally, both your mobile number and email address will be updated in the PAN database maintained by the Income Tax Department (ITD). This ensures that you’re promptly informed of any modifications to your PAN information, facilitating smooth communication and record-keeping for future interactions.

Read More: Reprint/Duplicate PAN Card Application on TIN-NSDL portal

Web Stories: Reprint/Duplicate PAN Card Application on TIN-NSDL portal

Official Income Tax Return filing website: https://incometaxindia.gov.in/

0 Comments