by Shakshi Bharti | Jun 29, 2024 | Income Tax

Important Keyword: F&O Trading, Intraday, ITR-3, P&L Statement.

Download Tax Profit & Loss Report from AngelOne

It allows you to download your Profit and Loss (P&L) Report online, which is crucial for calculating income tax on trading income. This report, similar to a Tax P&L statement, is essential for tax purposes. Traders also receive a “Trading Statement” that lists all transactions made across various segments over a specific period. This statement includes details such as:

- Date

- Time

- Script Name

- Purchase Price

- Sale Price

- Segment

- Quantity

These details help determine the tax liability.

Steps to download Profit and Loss Report from AngelOne

Follow these steps to download your Tax P&L

- Login to your trading account

- After you have logged in, navigate to Accounts

Select Tax P&L under Profit & Loss tab

- Select the “time period” you want to download the report for

- Now, you can view the downloaded Excel file

Read More: Download Tax Profit and Loss report from Motilal Oswal

Web Stories: Download Tax Profit and Loss report from Motilal Oswal

Official Income Tax Return filing website: https://incometaxindia.gov.in/

by Shakshi Bharti | Jun 29, 2024 | Income Tax

Important keyword: F&O Trading, Intraday, ITR-3, P&L Statement.

Download Tax Profit and Loss report from Motilal Oswal

Motilal Oswal allows you to download your Profit and Loss (P&L) Report online, which is crucial for calculating taxes on trading income. This report, similar to a Tax P&L statement, is essential for tax purposes. Traders also receive a “Trading Statement” that lists all transactions made across various segments over a specific period. This statement includes details such as:

- Date

- Time

- Script Name

- Purchase Price

- Sale Price

- Segment

- Quantity

These details help determine the tax liability.

Steps to download Profit and Loss Report from Motilal Oswal

- Go to the Motilal Oswal WebsiteYou can access it here.

- Click on “Login to Trade“From the Website

- Fill your Client code and password

And then click on “Login to MO Investor.”

- Click on the bot named “Talk to MO genie.”

On the bottom right

- Choose the option “Profit and Loss Statement.”

Once the bot chat box opens up

- The bot will ask you to select an option

You can select whichever Financial Year you wish to view

- Moving ahead, the bot will give you the start date and end date of that Financial Year you selected

Apart from that, the bot will give you an option of “Email” which means that your P&L report will be emailed to your registered Email address.

- Select the preferred “Ledger Statement” option

Choose this from the drop-down list.

- Select the Ledger Statement for the preferred timeline

Pick the time period from the options

- Lastly, after putting in all the details, your P&L Report will be emailed to your registered email address

Finally, you can go to your email and access it

Read More: How can taxpayers Track their High-Value Transactions?

Web Stories: How can taxpayers Track their High-Value Transactions?

Official Income Tax Return filing website: https://incometaxindia.gov.in/

by Shakshi Bharti | Jun 29, 2024 | Income Tax

Important Keyword: F&O Trading, ITR-3, P&L Statement.

Download Tax Profit and Loss report from Kotak Securities

Kotak Securities allows you to download your Profit and Loss (P&L) Report online, which is crucial for calculating income tax on trading income. This report, similar to a Tax P&L statement, is essential for tax purposes. Traders also receive a “Trading Statement” that lists all transactions made across various segments over a specific period. This statement includes details such as:

- Date

- Time

- Script Name

- Purchase Price

- Sale Price

- Segment

- Quantity

These details help determine the tax liability.

Steps to download Profit and Loss Report from Kotak Security

- Log in to your Kotak Securities portal

Visit the Kotak Securities portal and log in to your account by entering the required details.

- Next, the top bar go to “Reports“

Select “Trades”

- Then, the Trading report is displayed

There is an option to download the report. To download click on the “Down arrow” and choose “Excel“

- The file will be downloaded on your PC

Then you can view it.

Read More: Download Tax Profit and Loss report from ICICI Direct

Web Stories: Download Tax Profit and Loss report from ICICI Direct

Official Income Tax Return filing website: https://incometaxindia.gov.in/

by Shakshi Bharti | Jun 29, 2024 | Income Tax

Important Keyword: F&O Trading, ITR-3, P&L Statement.

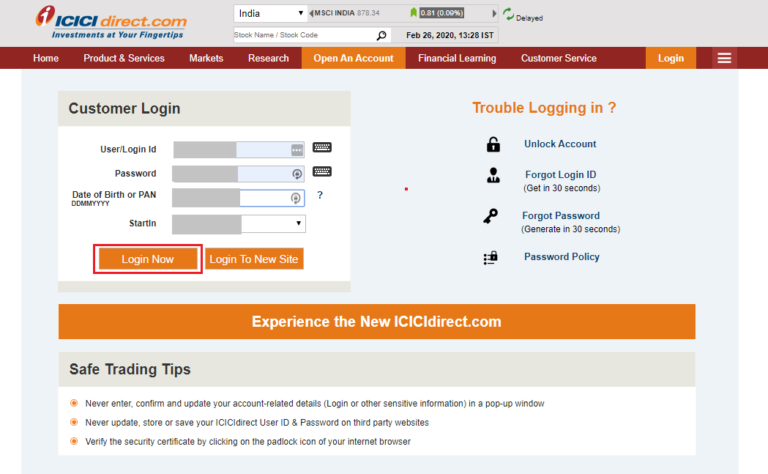

Download Tax Profit and Loss report from ICICI Direct

ICICI Direct allows you to download your Profit and Loss (P&L) Report online, which is crucial for calculating income tax on trading income. This report, similar to a Tax P&L statement, is essential for tax purposes. Traders also receive a “Trading Statement” that lists all transactions made across various segments over a specific period. This statement includes details such as:

- Date

- Time

- Script Name

- Purchase Price

- Sale Price

- Segment

- Quantity

These details help determine the tax liability and the applicability of a tax audit.

Steps to download Tax P& L report from ICICI Direct

- Log in to your ICICI Direct Account

You can do it from here.

- Navigate to Portfolio

Under ‘Portfolio’, select ‘Equity’.

- Select the Time Frame

Select the relevant Financial Year and Frequency. Press ‘View’.

- Download the Report

Press on ‘Download’ to download the report to your device.

Read More: Download Tax Profit and Loss report from Upstox

Web Stories: Download Tax Profit and Loss report from Upstox

Official Income Tax Return filing website: https://incometaxindia.gov.in/

by Shakshi Bharti | Jun 28, 2024 | Income Tax

Important Keyword: F&O Trading, ITR-3, P&L Statement, Trading Income.

Download Tax Profit and Loss report from Upstox

Upstox provides an option to download your Profit and Loss (P&L) Report online, which is crucial for calculating income tax on trading profits. This report, similar to a Tax P&L statement, is essential for tax purposes. Traders also receive a “Trading Statement,” listing all transactions made across various segments over a specific period. This statement includes details such as:

- Date

- Time

- Script Name

- Purchase Price

- Sale Price

- Segment

- Quantity

These details help determine the tax liability.

Steps to download Tax Profit and Loss report from Upstox

Follow these steps to download your Upstox Tax P&L

- Visit Upstox

- Login with your Upstox credentials

Enter the registered mobile number, OTP and 6-digit PIN

- Navigate to your Profile icon

Click on Reports & Corporate Actions

- Navigate to Reports

Click on Profit and Loss

- Navigate to Tax

Select the Financial Year and click on Download report

- An Excel sheet will be downloaded into your system

You can access this file from “downloads” on your PC

Read More: Download Contract Note for Traders from Zerodha

Web Stories: Download Contract Note for Traders from Zerodha

Official Income Tax Return filing website: https://incometaxindia.gov.in/