Important Keyword: Belated ITR, Income Tax Account, ITR Form, ITR Utility, Sec 139(4).

Table of Contents

How to file Belated Return u/s 139(4)?

A belated return, as defined under section 139(4) of the Income Tax Act, is a return filed by a taxpayer after the due date. Here are the methods through which belated returns can be filed:

File Belated Returns 139(4): Online on Income Tax Website

1. Login to your account on the income tax e-filing website.

Enter your user ID (PAN) and password and click on ‘Login’ on the income tax filing website.

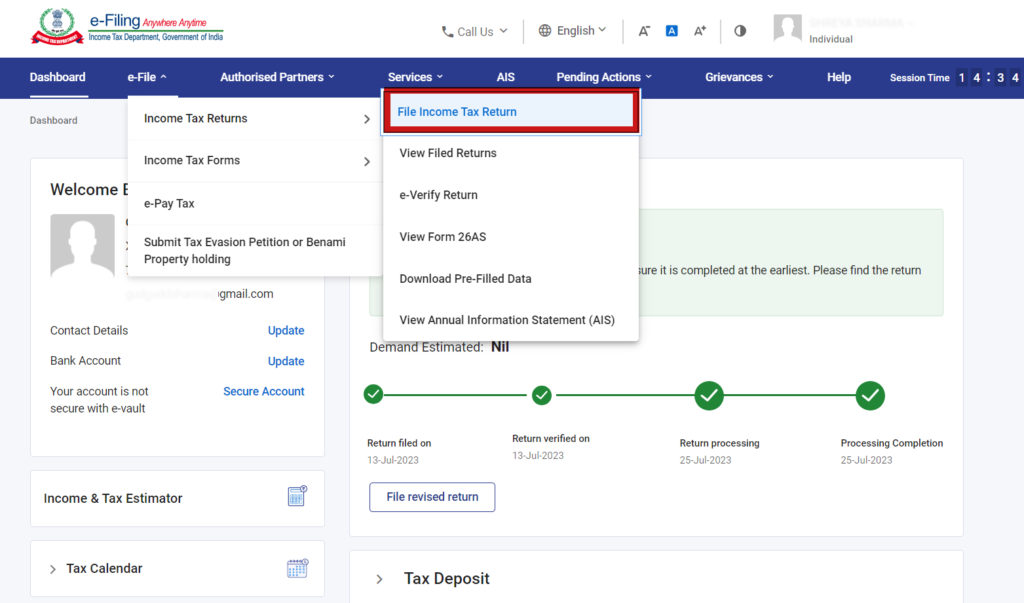

2. Navigate to File Income Tax Return

Click on e-File > Choose ‘Income Tax Returns and Select File Income Tax Return

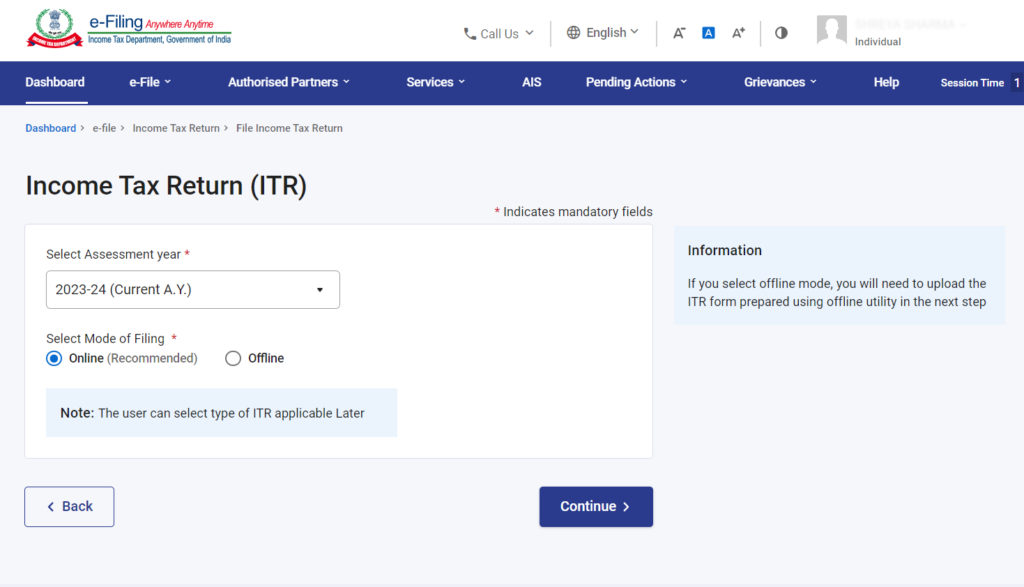

3. Enter the Assessment Year and Filing Mode.

Select the relevant AY for filing and online mode.

4. Select the Status Applicable

Select the status of filing.

5. Choose the ITR form Applicable

6. Click on the ‘Personal Information’ section and ensure all your personal details are correct.

7. Scroll down to the filing section and select 139(4).

8. Fill in all your income details under various source heads and proceed to make the tax payment and Submit the ITR.

File Belated Returns 139(4): Using ITR Preparation Utility

Download Offline ITR Preparation Utility and prepare the ITR. Once done, upload the .json file and proceed to verification.

- Login to the filing Income Tax Website.

Navigate to E-file> Income Tax Return > File Income Tax Return.

Select the Relevant Assessment Year, Offline Mode of Filing, Filing Type as Section 139(4): Belated Return and Continue.

Attach the JSON file generated using Offline Utility and proceed to verification.

Ensure to e-verify the return.

Read More: Budget 2020 : Highlights

Web Stories: Budget 2020 : Highlights

Official Income Tax Return filing website: https://incometaxindia.gov.in/